Contents

- Important information about ClaimsView

- What do I need to do in ClaimsView?

- Help with ClaimsView - steps

ClaimsView

If you've submitted a reimbursement claim since the scheme started, it will need to be reviewed in ClaimsView.

In ClaimsView, we need you to supply the correct annual rate of pay for each return period and the date at which the claim was made.

Overview

QLeave is undertaking a remediation program to review claims made before 5 August 2024. Where necessary, employers will be reimbursed for any outstanding money owed. This work resulted from an error we identified relating to the annual rate of pay calculation collected through quarterly employer returns. You can read more about the new annual rate of pay calculation guidance here.

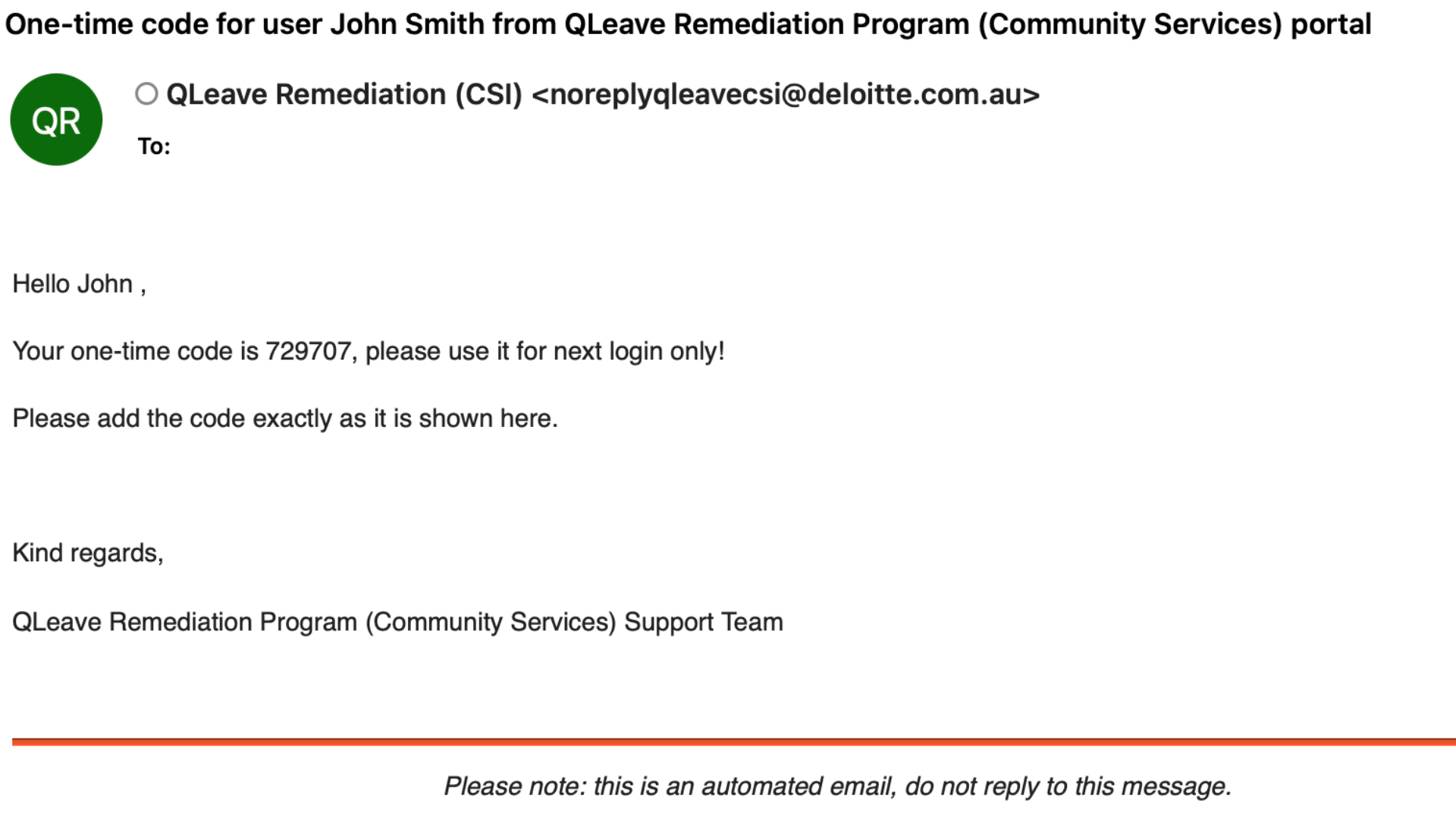

What is ClaimsView?

We are using an external, secure portal called ClaimsView, which is hosted by Deloitte. This portal will collect correct annual rate of pay information about your workers to evaluate if you're entitled to reimbursement.

For help using ClaimsView, you can use the user guide and frequently asked questions below.

What do I need to do in ClaimsView?

You will need to download a data template and enter this information about your worker:

- applicable industrial instrument: sets the minimum wages, conditions and entitlements for employees and employers covered within their scope

- classification level: is the level or grade a worker is classified at under the industrial instrument that applies to the worker. The classification level may be determined based on the worker’s role, duties and responsibilities, qualifications, experience or other considerations

- pay point level: some industrial instruments include pay points for employees to progress through as they gain experience and qualifications.

- annual rate of pay: the annual equivalent minimum wage for a worker’s classification level and pay point under the applicable industrial instrument.

- different to gross ordinary wages and not based on your workers' actual earnings AND

- used to calculate the value of reimbursement claims and doesn't impact the quarterly levy.

Please note, annual rate of pay is based on your workers' minimum full-time hours, not on the hours they worked, even if they're part-time or casual. This means it's:

Key information

- You must make sure you're using the applicable award for each date in the data template as the financial year may differ for each claim or return. You can find current and historical versions of industrial instruments in the agreement and awards section on the Fair Work Commission's website here.

- The only entitlement under an industrial instrument that should be factored into the annual rate of pay is the minimum wage, as varied by an equal remuneration order (ERO), if applicable.

- If your worker's industrial instrument is covered by an enterprise agreement, it's important you provide the full name of the agreement.

- If no industrial instrument applies to your worker, you must provide the annual rate of pay for the prescribed classification level under the Community Services Industry (Portable Long Service Leave) Regulation 2020. This classification level is the ‘Social and community services employee level 4—pay point 4’ under the Social, Community, Home Care and Disability Services Industry Award 2010.

Help with ClaimsView - steps

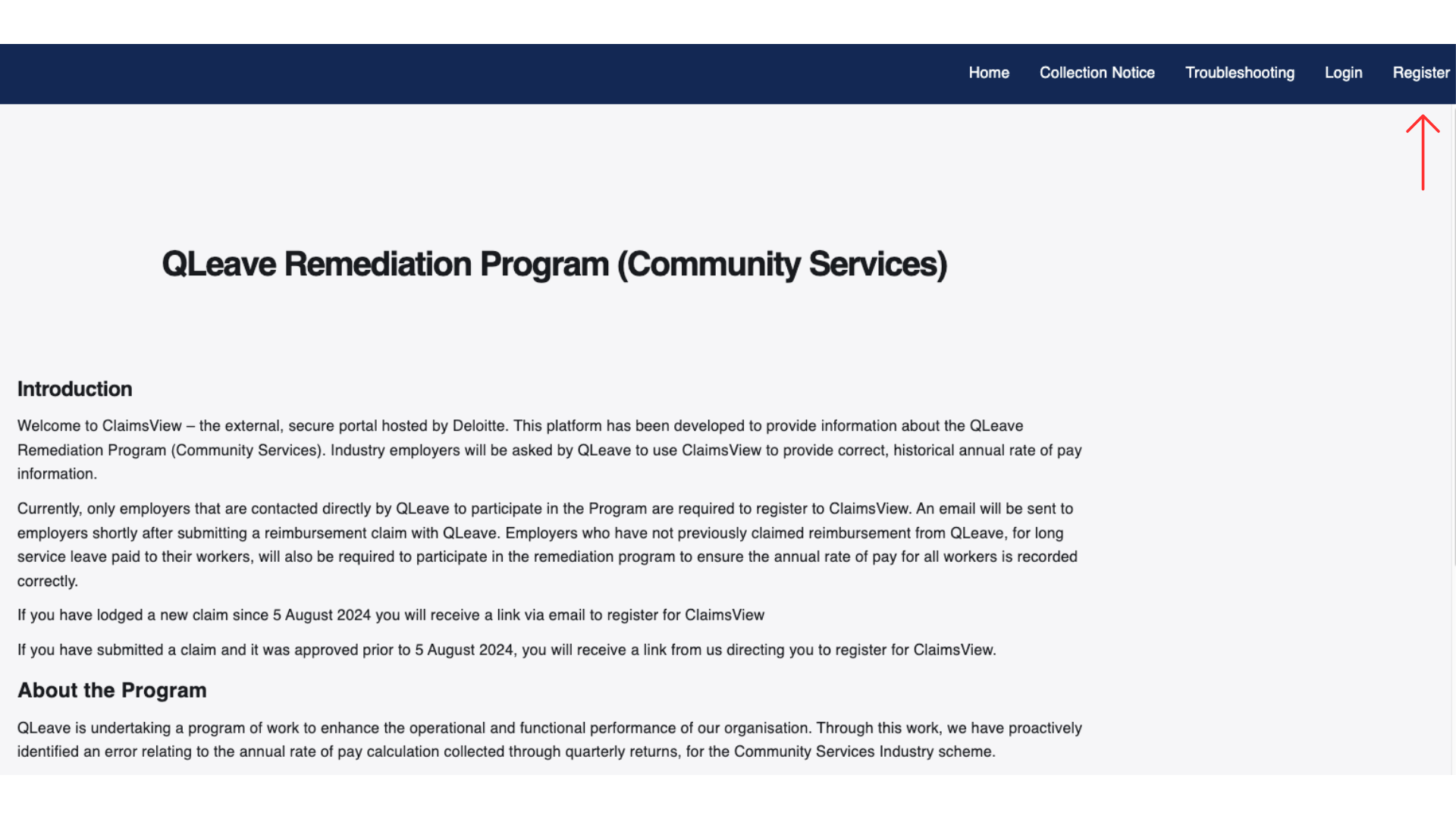

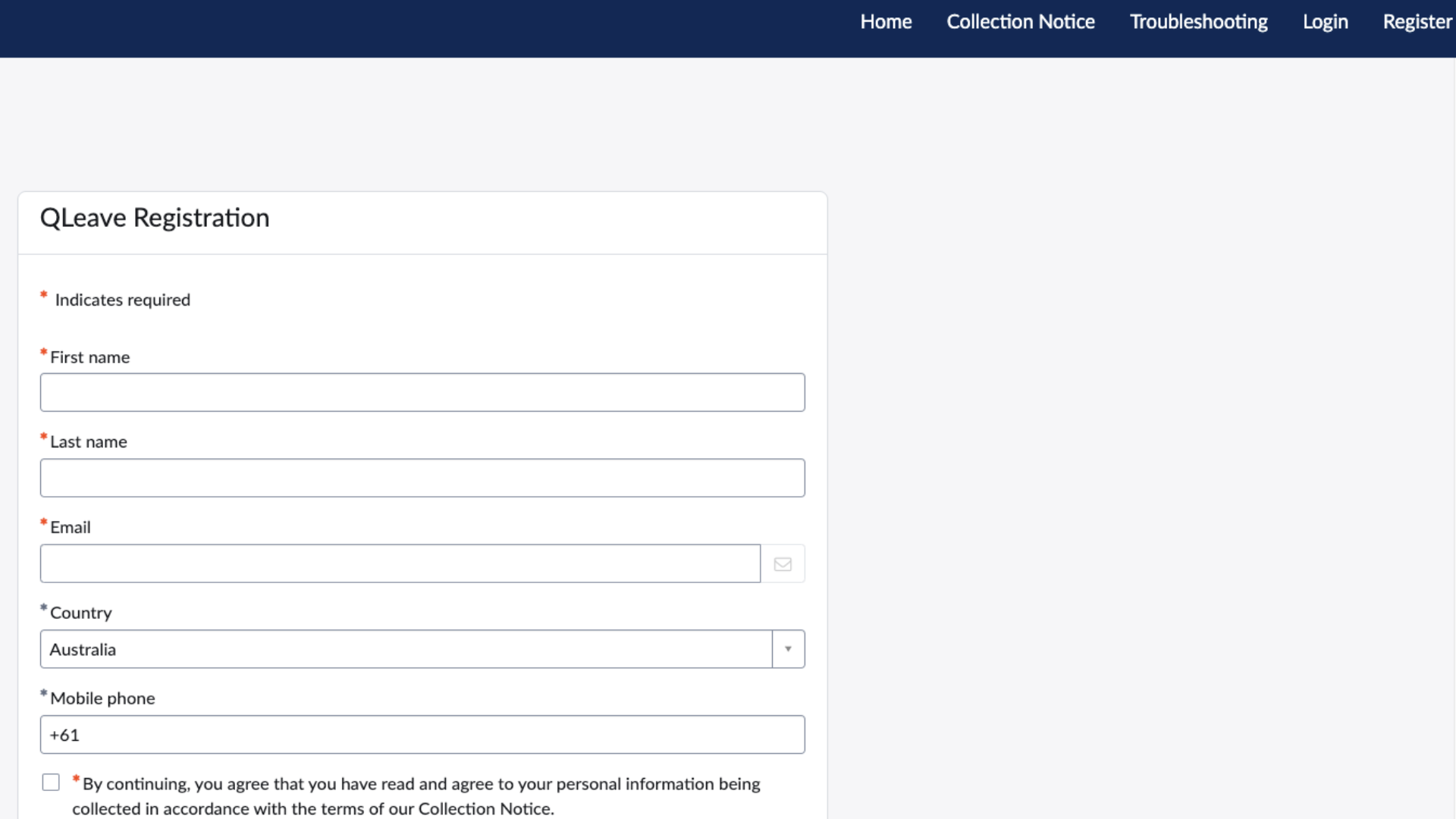

Register for ClaimsView

You may receive an email inviting you to register for the ClaimsView portal or you can register here.

On the ClaimsView portal home page click the Register tab at the top right corner.

Fill in the fields below.

Enter your email address and create a password. For security reasons, a one time password (OTP) will be sent to your nominated email address each time you login to ClaimsView.

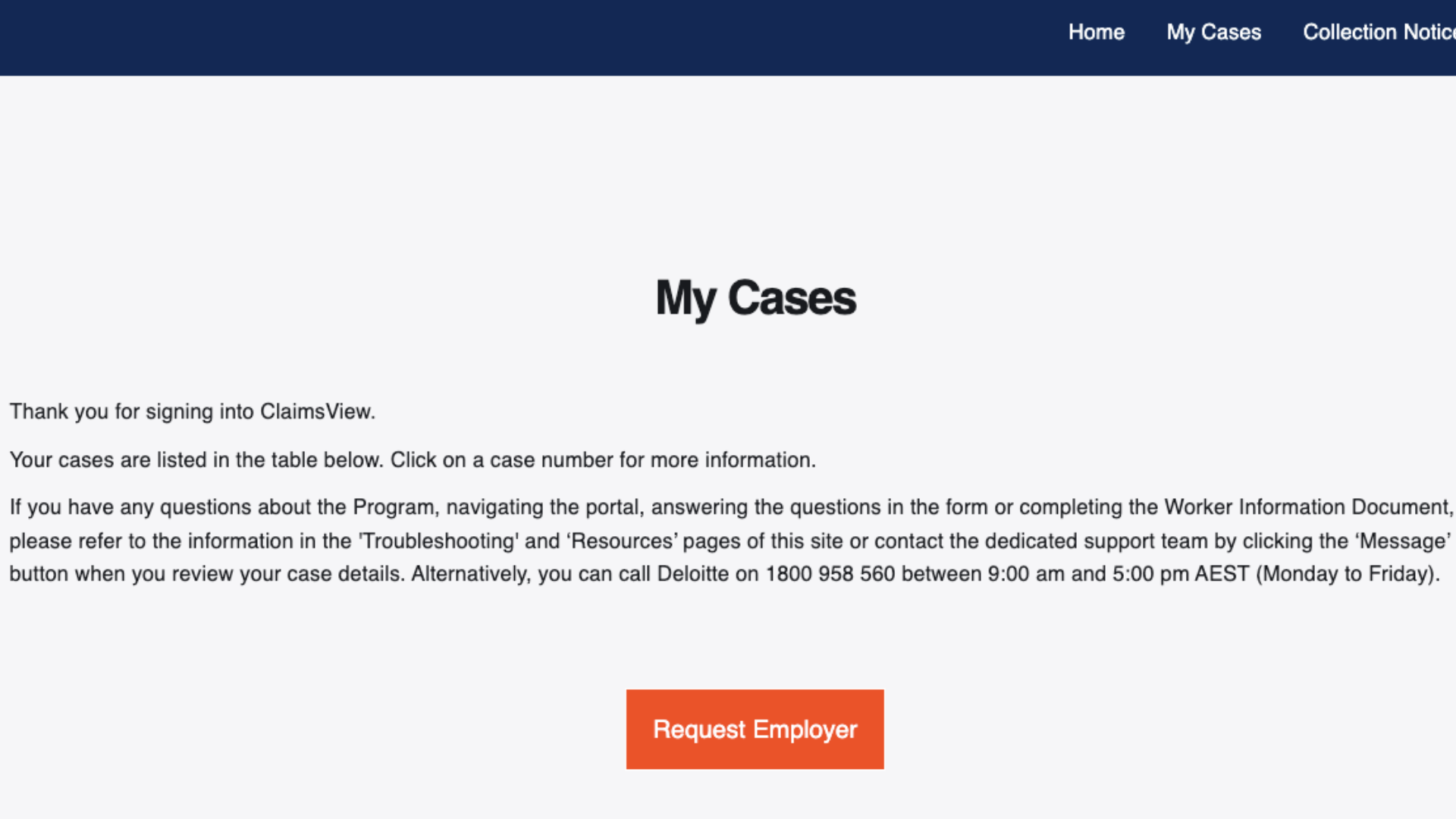

Select Request employer and fill out the required information if you can't see any cases.

Steps to completing your worker cases

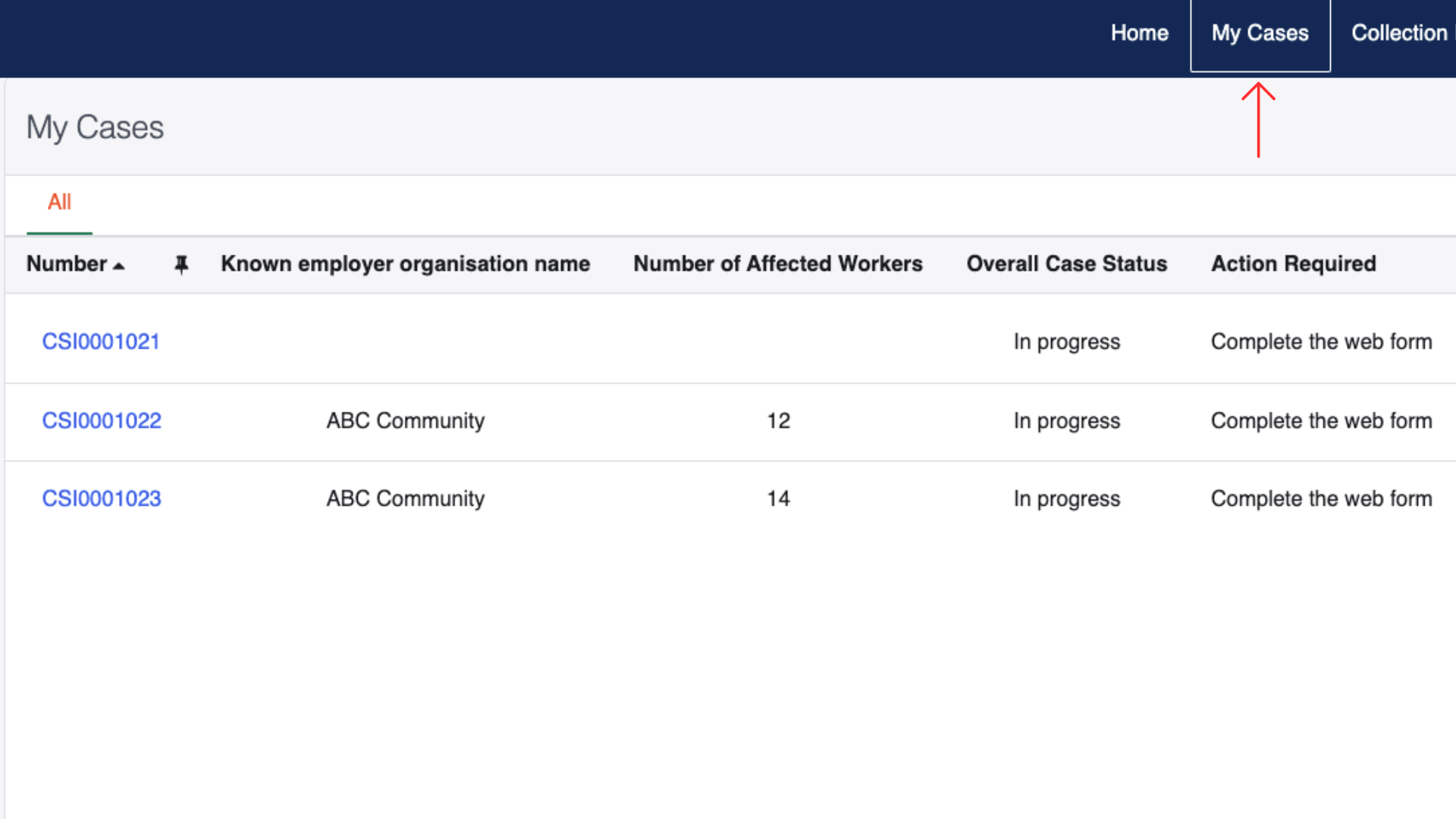

Through ClaimsView, we need you to supply the correct annual rate of pay for each return period and the date at which the claim was made. You might have more than one organisation (case) to provide information for. Follow these steps to complete each case:

1. Select the My Cases tab up the top of the page to see the cases you have to provide information for.

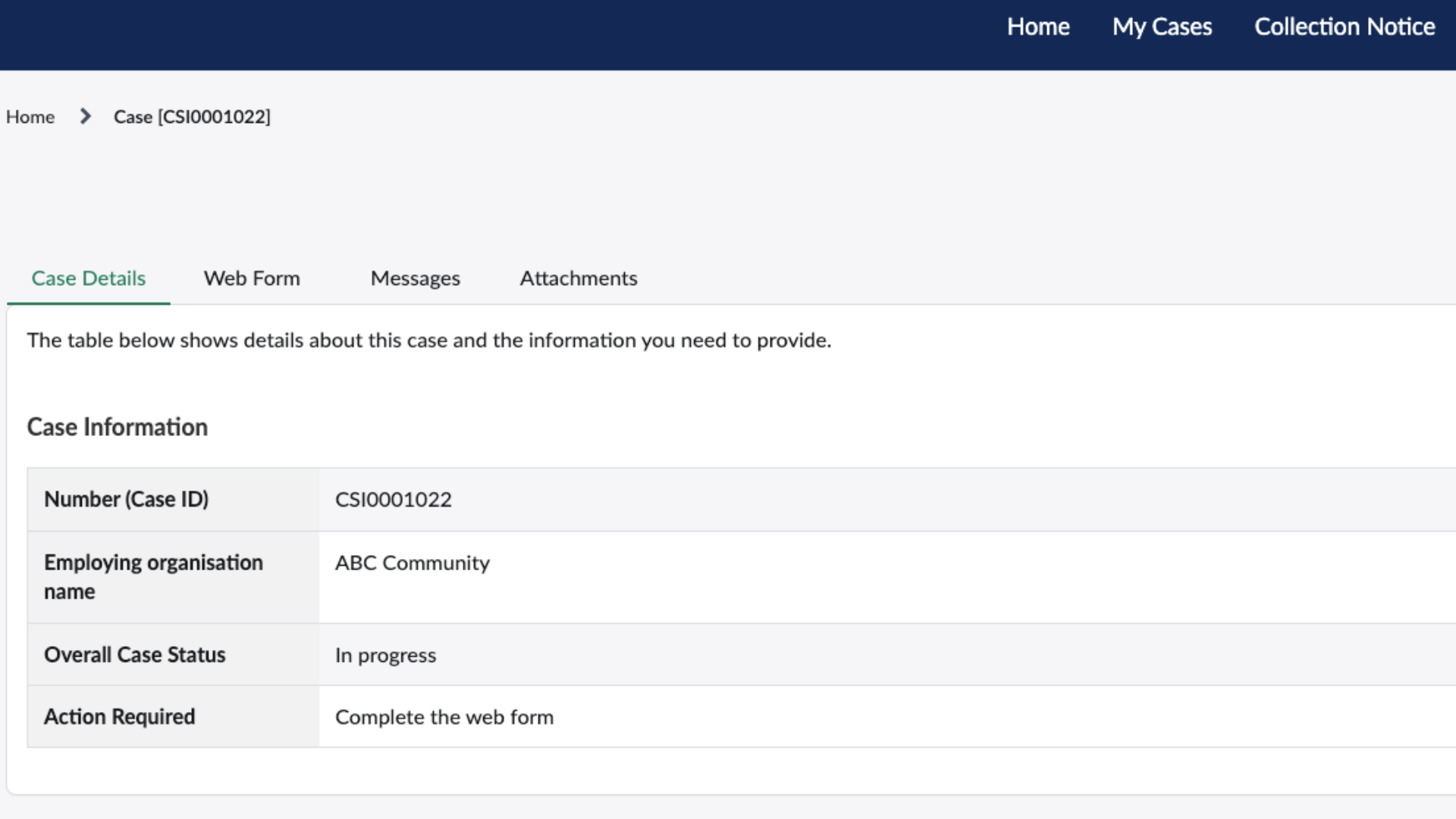

2. Select one of the case numbers and you will be able to see the details of each organisation you are providing information for.

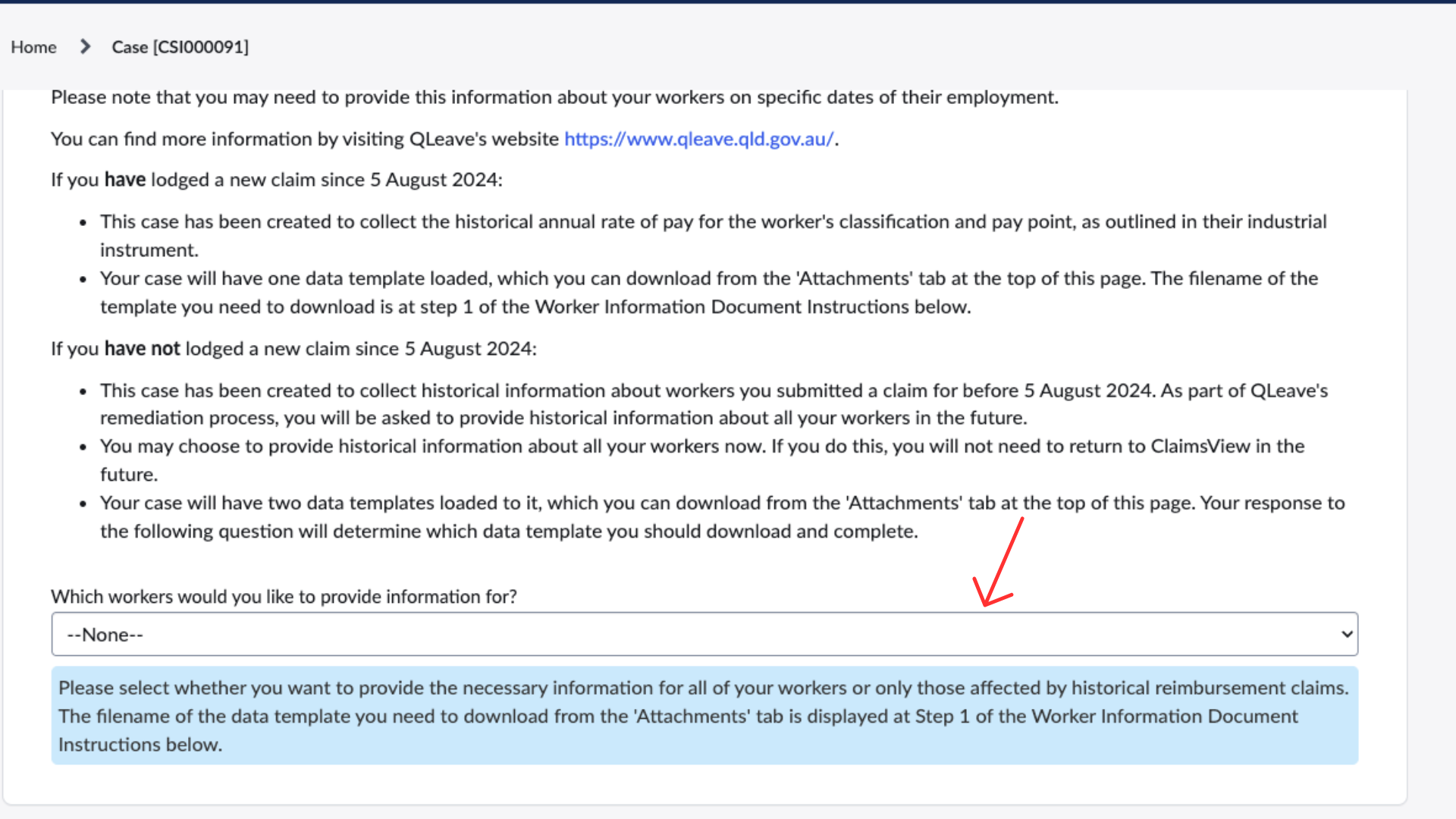

3. To begin work on your case, click Web Form, scroll down the page and choose to provide information for only the workers who have made a claim before 5 August 2024 (partial) or all your workers (full). From the dropdown menu select:

- only workers affected by historical reimbursement claims (partial) OR

- all my workers (full).

Please note, if you complete a partial return you will need to go back into ClaimsView in the future to provide information for all your workers.

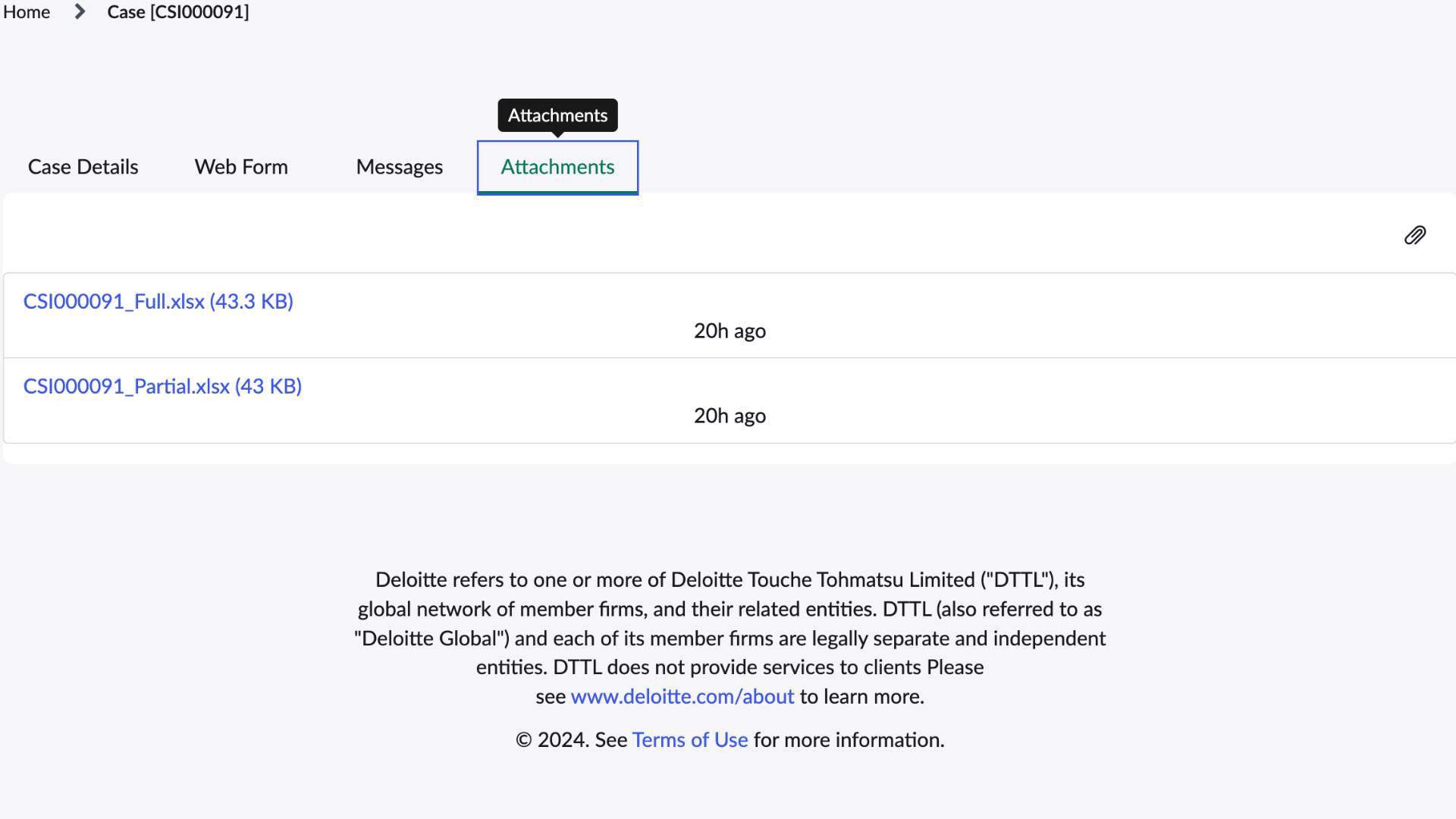

4. Select the attachments tab and download the data template.

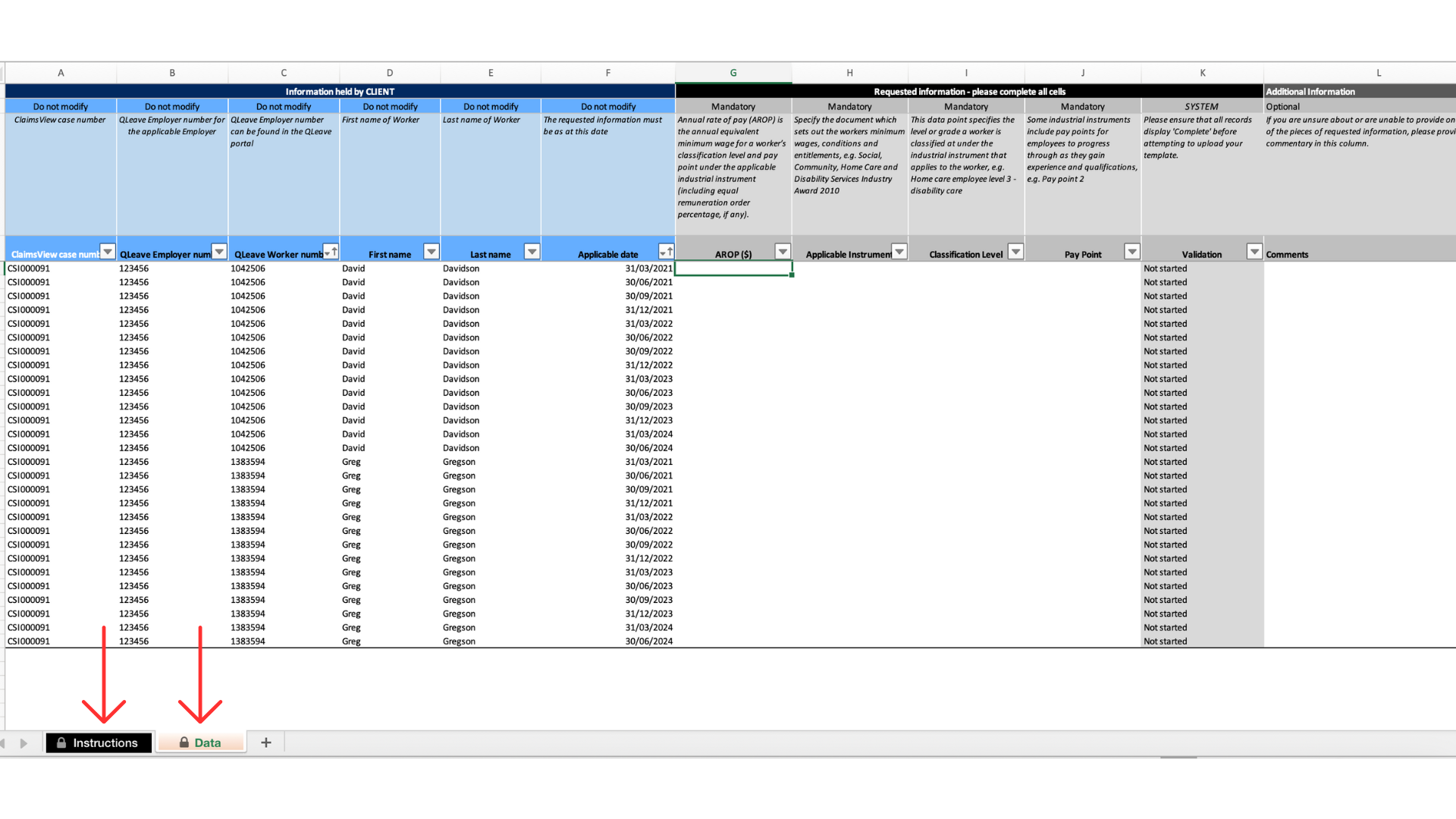

5. Once you've downloaded your spreadsheet you can start entering annual rate of pay information for each worker. Make sure to review the pre-filled information:

- Employer number

- Worker number

- First name and last name

- Applicable date

You will need to provide the following information for each worker at each applicable date in the data template:

- Annual rate of pay (using the correct calculation guidance)

- Applicable industrial instrument

- Classification level

- Pay point

You can find more information in the instructions section of the data template.

Please note:

- If you can't provide information in any of the fields, please explain why in the additional information section.

- You may need to provide this information at different times of their employment.

- Make sure to save the data template to your computer so you can upload it when it's complete.

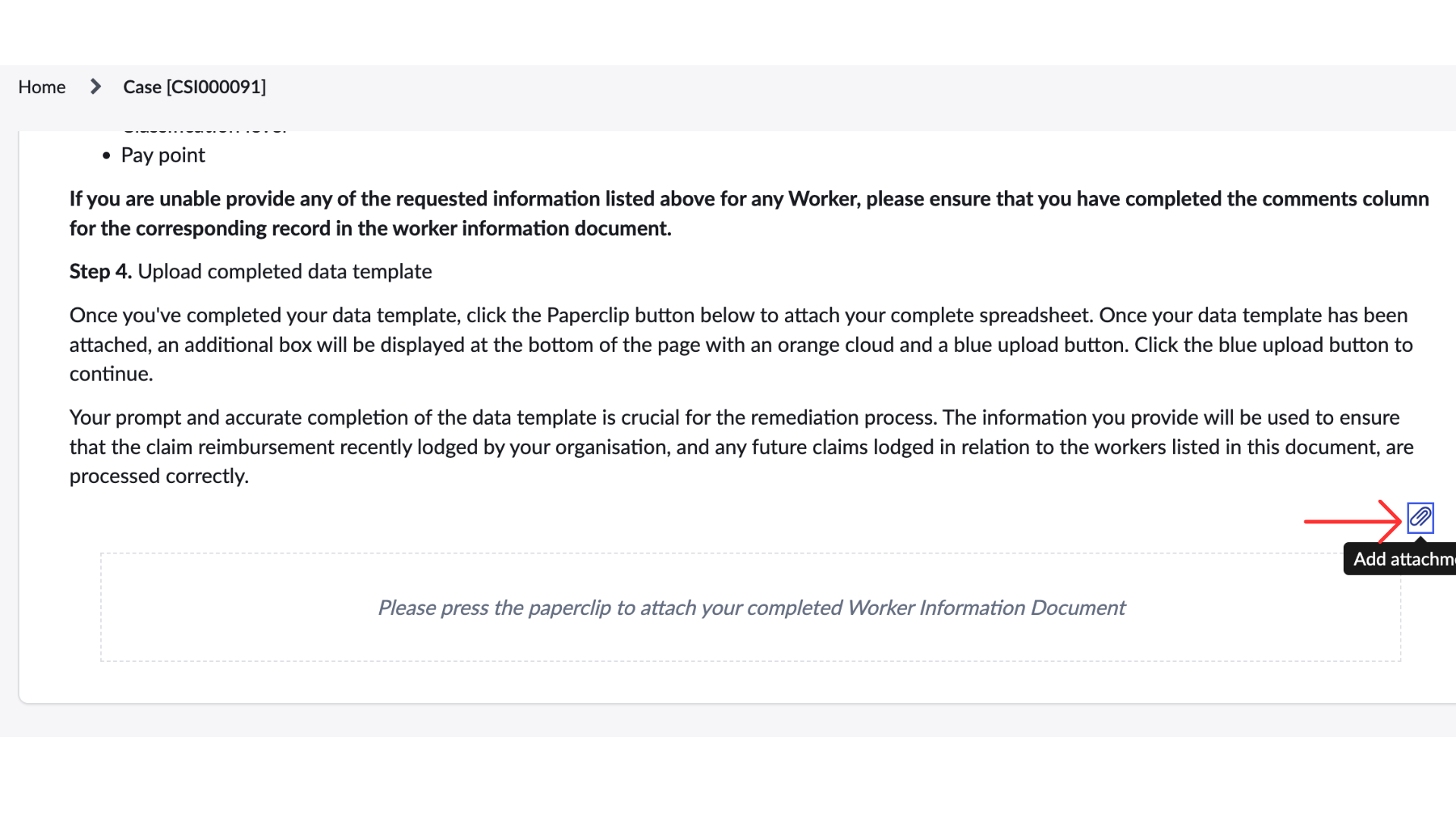

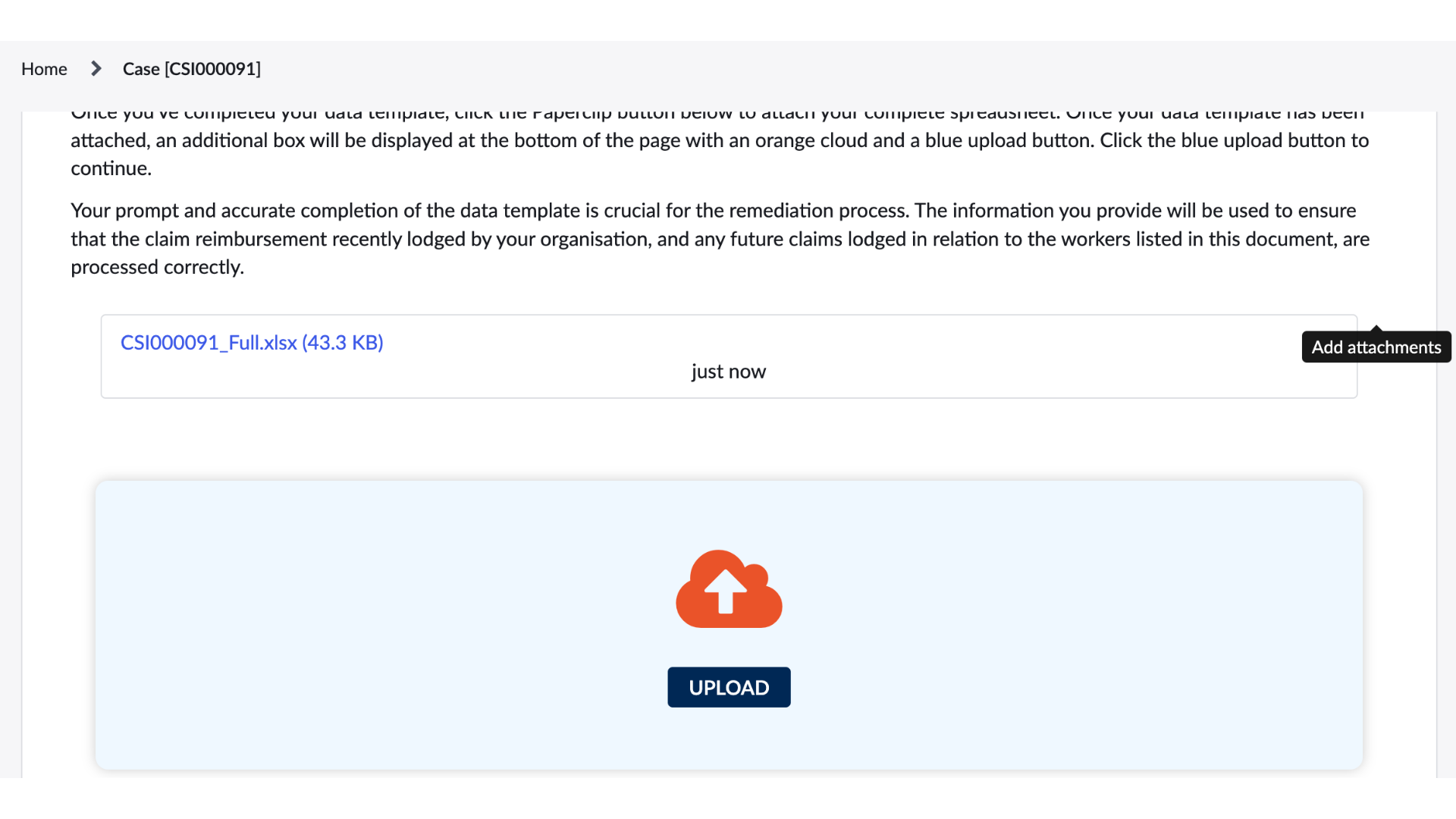

6. Once you have completed the data template, go back to the Webform section in the portal, scroll down and select the paperclip.

7. Select your completed data template and select upload.

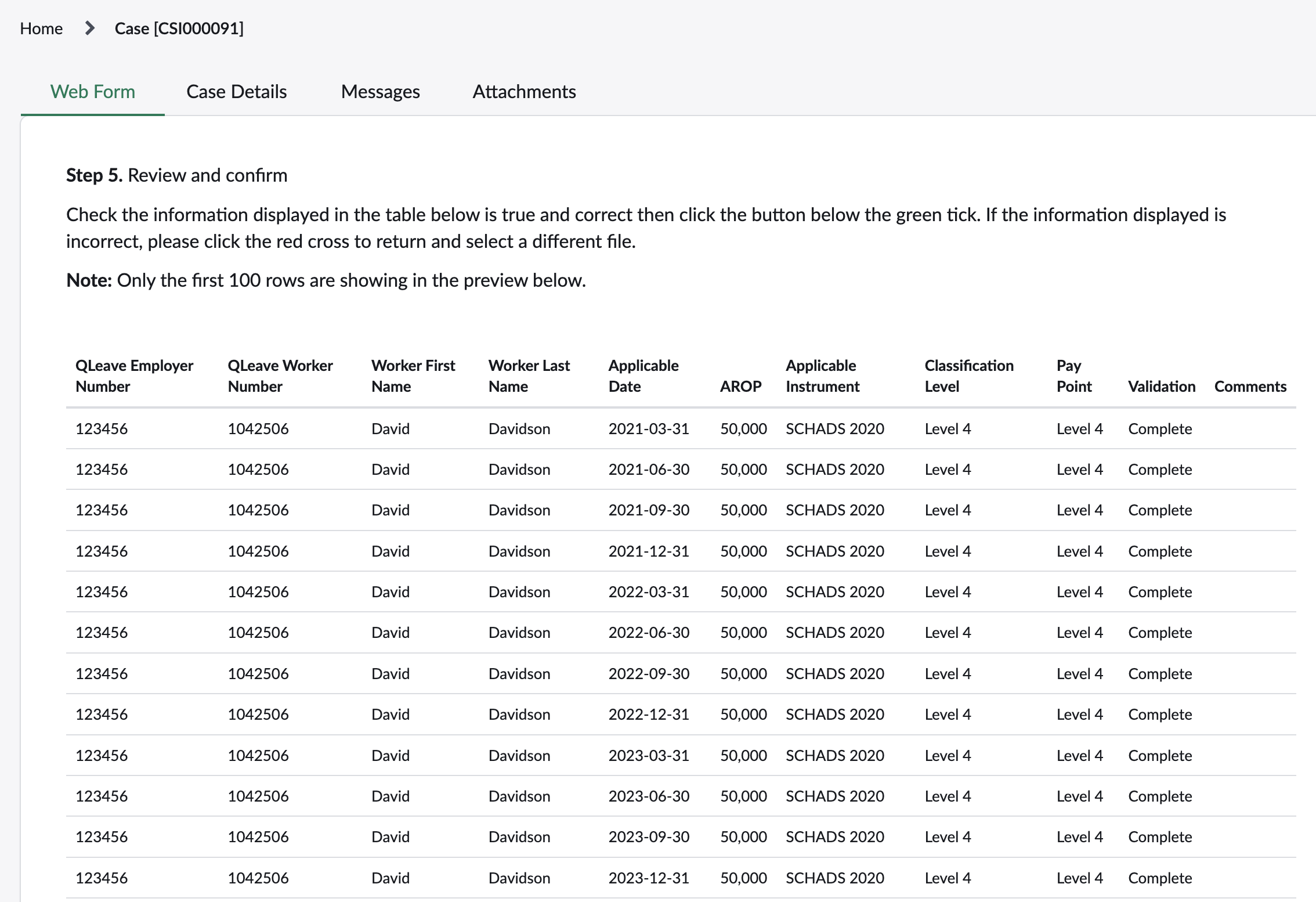

8. You'll see a preview of the first 100 rows of your data template. Make sure to check all the information is correct.

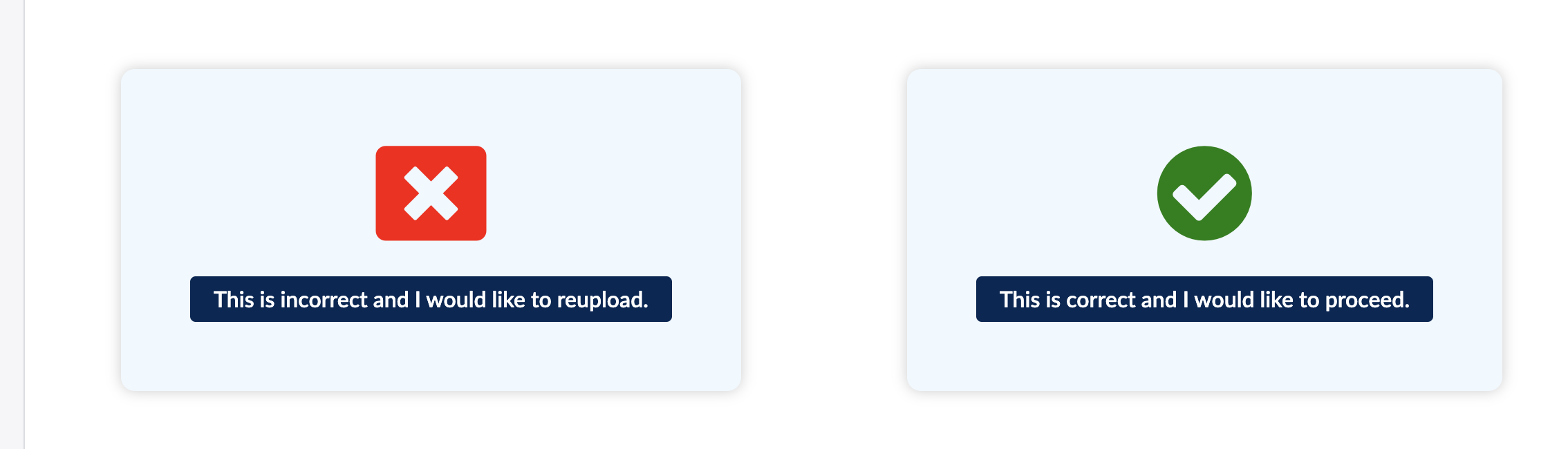

9. Scroll down the page and select if the information is incorrect or correct.

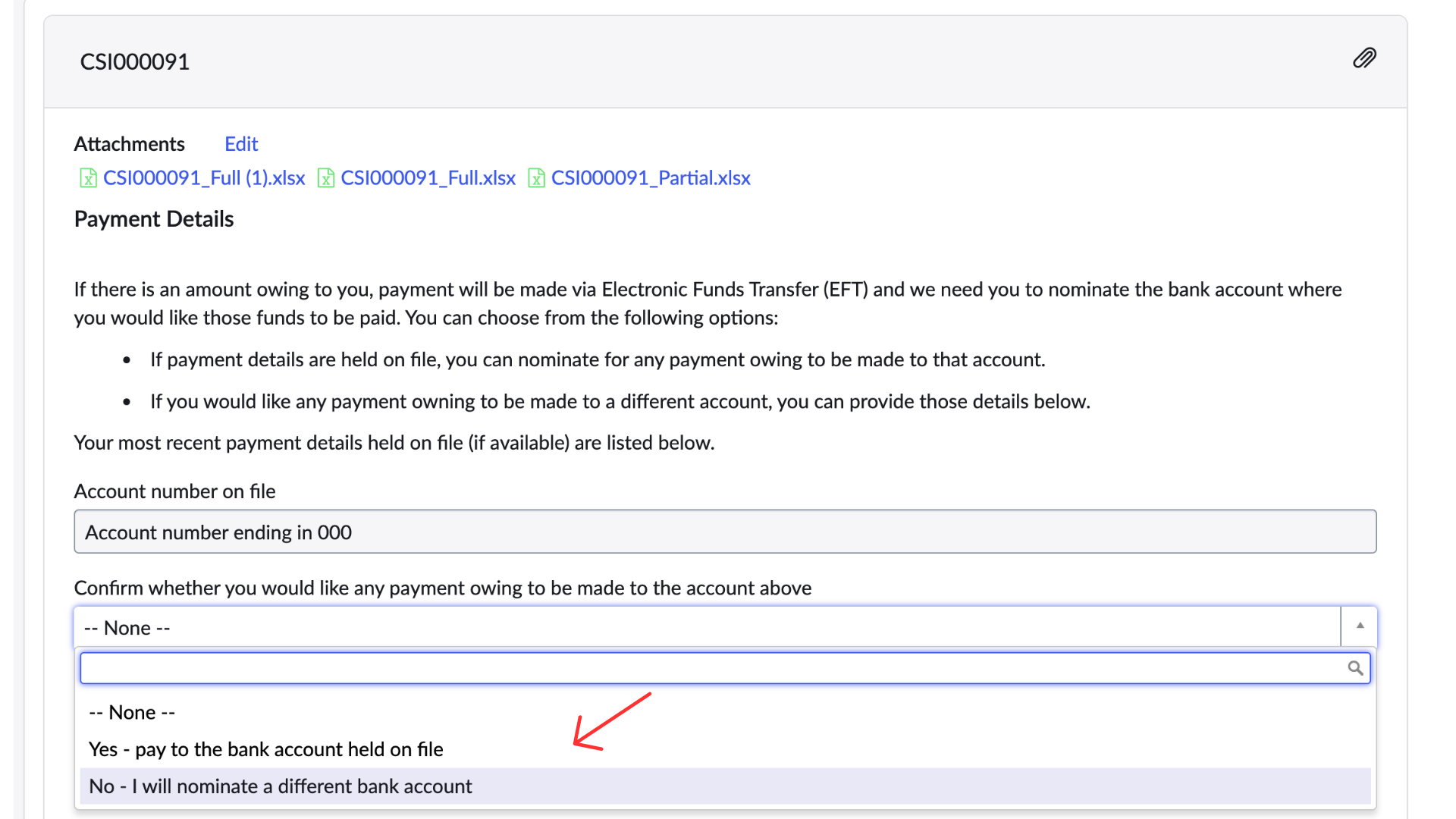

10. Check the payment details we have on file are correct. If you select no, you need to enter your bank details.

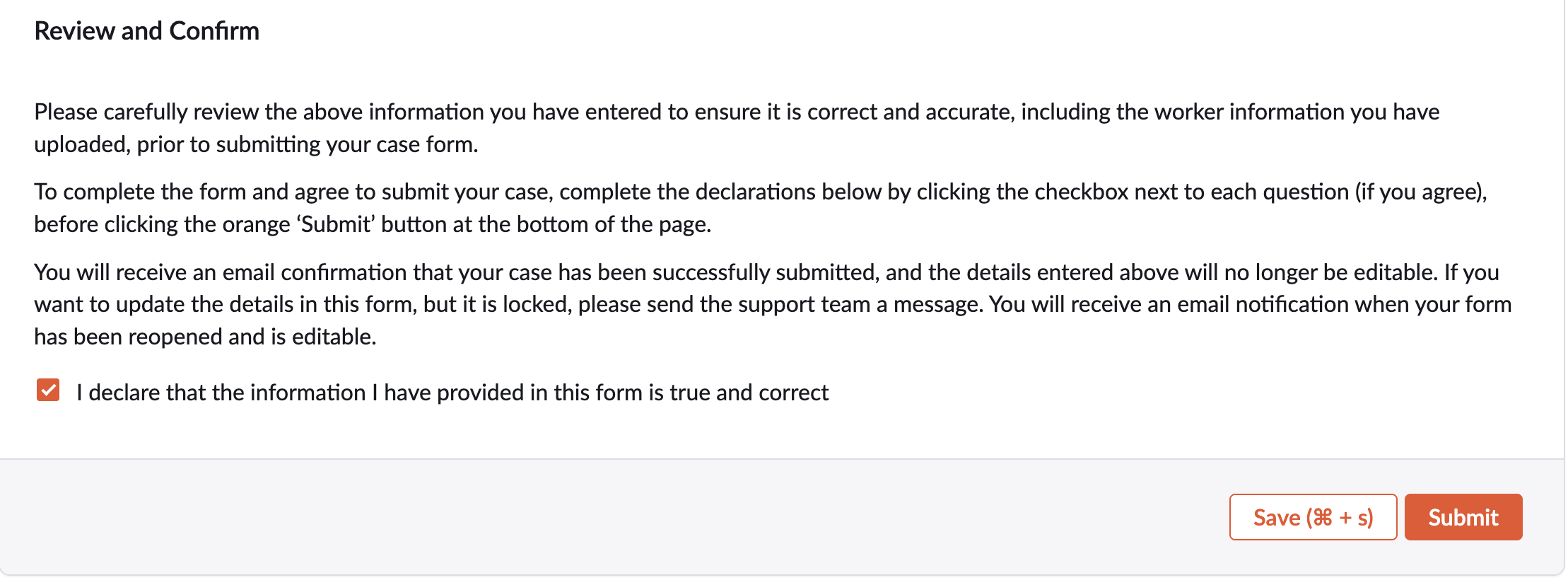

11. Select the check box to confirm that all the information you have provided is correct.

12. You will receive the message below if your case has been submitted.

13. You will also receive a confirmation email.

Frequently asked questions

Q: Are there any costs associated with participating in the remediation program?

A: No. There are no costs associated with participating in the remediation program. Once you provide the correct annual rate of pay information for each of your workers, QLeave will reassess the claim calculation/s and reimburse the correct amount to your organisation, if an adjustment is needed.

Q. What is ClaimsView and how does it work?

A. ClaimsView is an external, secure employer platform hosted by Deloitte. ClaimsView is designed to manage, process, and resolve claims securely and efficiently. The portal can be accessed via a link provided to you by email or here.

Details of how Deloitte stores and manages your personal information and information for your organisation can be found in ClaimsView under the Collection Notice tab.

ClaimsView will invite you to register an account and create a password. You will be sent a One Time Password (OTP) to complete the registration.

Q. Do I need to enter a one-time pin every time I log in?

A. Yes, for your security whenever you try to log in to the platform a new six (6) digit password will be generated and sent to your email account.

Q. Why is there no case for my organisation in ClaimsView?

A. A 'case’, and accompanying worker data template that clearly sets out the information that must be provided by each employer, has been prepared for each organisation.

Before you can access this, we must authenticate your identity and relationship with the employer. To do so, please complete the ‘Identity details’ section of the form when you login to ClaimsView for the first time. Once the name and corresponding QLeave employer number for your organisation has been checked against QLeave’s records, your ClaimsView account will be linked to cases pre-filled with information and attachments specific to your organisation(s).

Q. What if I manage multiple employer organisations?

A. Each employer must have a unique ‘case’ in ClaimsView. Please ensure you enter only one employer organisation name and matching QLeave employer number when you complete the identity details section of the form. When your ClaimsView account is linked, a case will be listed for all employers for which you are the nominated primary contact in QLeave’s register of employers.

You’ll need to download, complete and upload a separate data template for each employer via the ‘Attachments’ tab. Please pay close attention to the file naming requirements specified in ClaimsView to ensure the data you provide is processed accurately.

Q. What if my organisation does not have the information requested? What if I no longer have access to older payroll/worker records?

A. For additional support with this remediation program, please contact QLeave.

Q. What if some of the workers I’m providing information for are no longer employed by our organisation?

A. QLeave needs to ensure the correct annual rate of pay is recorded for all workers, since the scheme started in January 2021. This means you will need to provide the historical data for all your workers, including those who are no longer employed by your organisation.

Q. How much time does my organisation have to provide data and complete the ClaimsView process?

A. For new reimbursement claims, QLeave asks that you provide the corrected annual rate of pay information for your worker so we can process your claim as quickly as possible.

Once QLeave starts collecting data from employers who have previously made a reimbursement claim, you will have approximately 12 weeks to provide the necessary data and complete the ClaimsView process.

Q. Why is there an option to provide historical information for all workers? What is this for?

A. QLeave needs to ensure the correct annual rate of pay is recorded for all workers, since the scheme started in January 2021. This means you will need to provide the historical data for all your workers, including those who you have not paid long service leave to (and claimed reimbursement from QLeave).

All employers, even those who have not previously claimed reimbursement from QLeave for long service leave paid to their workers, will also be required to participate in the remediation program in the future. This will ensure the annual rate of pay for all workers is recorded correctly.

Q. The records used for my organisation’s calculations appear to be incorrect, what do I do?

A. If you think the records are incorrect, we will need your assistance to identify the correct records and relevant information for us to investigate any differences. Please use the message function in ClaimsView to send a message (including any attachments) to help resolve this.

Q. What documentation will my organisation receive on completion of the remediation process?

A. If you are providing historical annual rate of pay and industrial instrument information for workers, for a new reimbursement claim, you will be notified when the claim has been processed and paid.

If you have been asked to provide historical information for previously reimbursed claims, you will receive an outcome assessment letter.

Q. What happens if my organisation fails to comply with the remediation program?

A. QLeave has established a customer service team specifically to support employers with the remediation process. It is critical that we do the annual rate of pay remediation work so that workers’ entitlements are correct in the future.

Q. Can I use third-party services (e.g. external accountants or advisors) to assist in the remediation process or provision of information?

A. For a third-party to assist in the remediation process, they will need to be listed on your QLeave employer registration as an authorised contact.

Q. How much will my organisation get paid?

A. If you have been asked to provide historical information for previously reimbursed claims, you will receive an outcome assessment letter. Once the assessment is completed, your outcome letter will advise if there is an adjustment payment required.

Q. If my organisation is owed an adjustment payment, how will my organisation get paid?

A. Once our data team have processed the historical claims and returns information you submit in ClaimsView, you will receive an outcome letter that details your organisation’s adjustment payment.

To receive payment, you will need to nominate bank account details for the employer you are representing. Each adjustment payment you are eligible for will then be made into the nominated bank account.

If banking details are already held on file for your organisation by QLeave, you may select these when completing the payment details section. If applicable, you can find these in the ‘Claim Details’ tab in the portal, displayed as ‘Account ending in XXXX’.

Q. What do I do if my organisation didn’t receive the adjustment payment?

A. If you have:

- submitted the required historical claims and returns information for impacted workers;

- received an outcome letter that indicates you are eligible for an adjustment payment;

- provided your employer’s bank account details in the ‘Payment details’ section of the form;

- submitted the form;

- received a confirmation email that your payment has been processed; and you have still not received payment after 10 business days have elapsed, please contact our support team at [1800 958 560] so they can confirm the status of your payment.

Q. Will my organisation be paid interest on the adjustment payment?

A. No.

Q. What if I can’t access ClaimsView or complete the worker data template?

A. For additional support with this remediation program, please contact QLeave.

Q. Can I request an extension for submitting the requested information?

A. For additional support with this remediation program, please contact QLeave.

Q. What do I say if workers ask about this and will it affect any current long service leave calculations?

A. As the community services industry scheme was launched in 2021, workers are unable to make a claim for long service leave through QLeave until 2028. This issue only impacts employers who have made a claim for reimbursement from QLeave, for long service leave they have paid to a worker. It is critical that we do the annual rate of pay remediation work so that workers’ entitlements are correct in the future.

Q. I would like to dispute my organisation’s adjustment payment, how do I go about this?

A. If you have any questions, please refer to the 'Resources' page on ClaimsView where you will find frequently asked questions and an illustrative calculation guide. You can also contact the dedicated support team by using the message function in ClaimsView or calling 1800 958 560.

Q. Who do I speak to if I need further help with the ClaimsView portal?

A. If you have any technical questions, please refer to the Troubleshooting tab at the left-hand side of the ClaimsView site. For further technical advice or assistance, there is a messaging function within ClaimsView where you can digitally connect with a Deloitte support officer.

Alternatively, you can contact Deloitte on [1800 958 560].