Contents

- How to calculate annual rate of pay

- Important information about annual rate of pay

- What happens if my worker is part-time or casual?

- Key definitions

- Help with annual rate of pay - steps, video and frequently asked questions

Annual rate of pay

From 5 August 2024, QLeave will ask you to calculate your worker's annual rate of pay slightly differently from how you have in the past.

You'll still need to tell us your worker's annual rate of pay in each quarterly return and when you make a long service leave claim, so please ensure you are following the calculation guidance below.

What's different about the calculation?

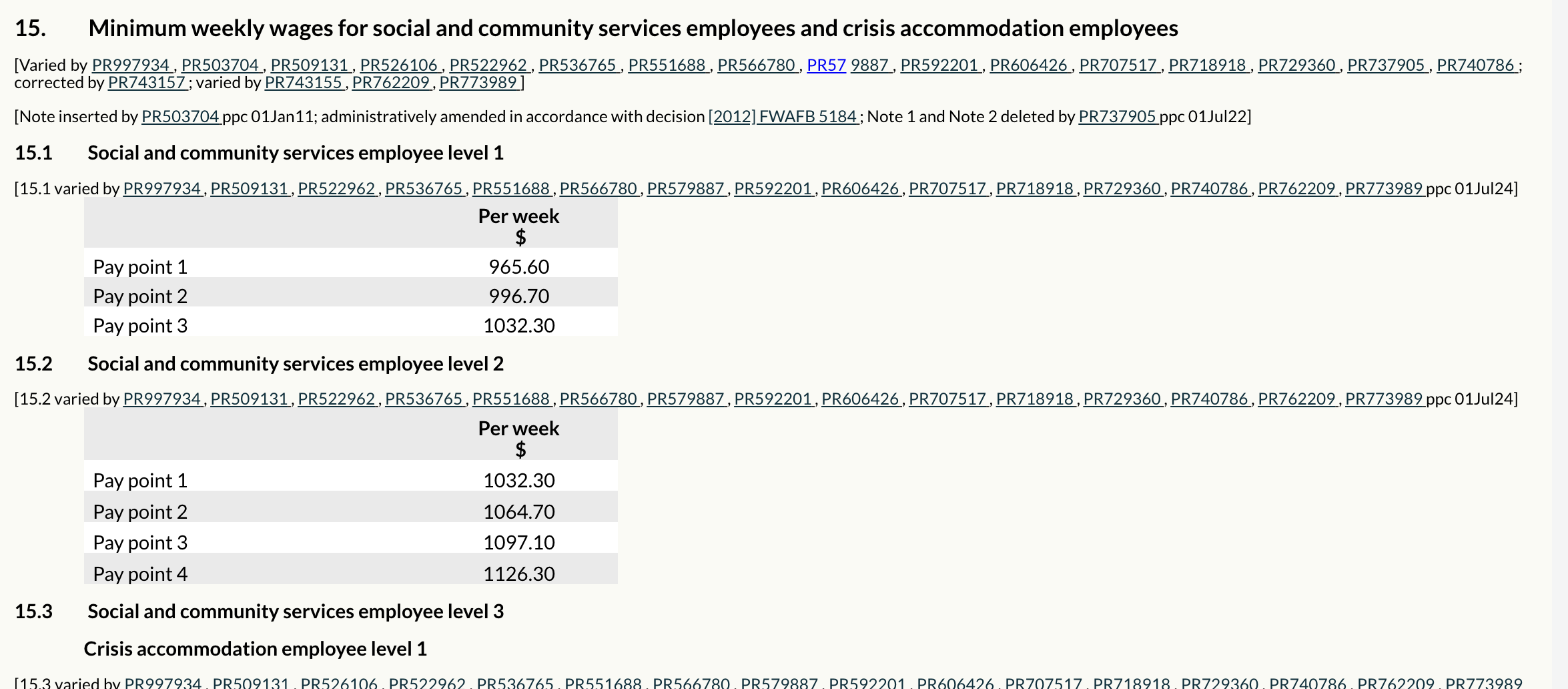

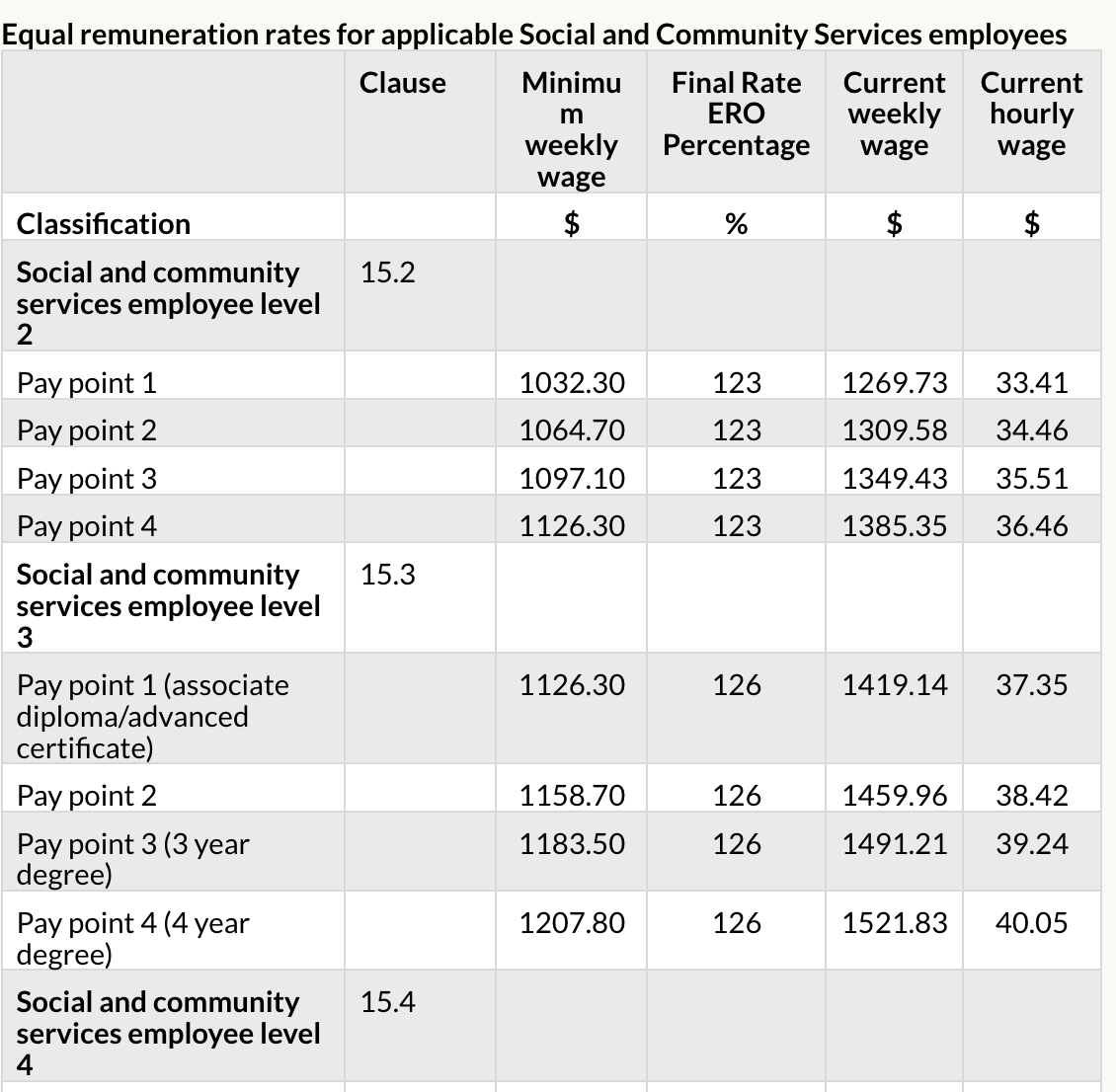

You'll need to provide your worker's annual equivalent minimum wage for their classification level, pay point and industrial instrument (including equal remuneration order percentage, if any). You can use the steps below to help you find this information about your worker.

Please note, if no industrial instrument applies to your worker, you must provide the annual rate of pay for the prescribed classification level under the Community Services Industry (Portable Long Service Leave) Regulation 2020. This classification level is the ‘Social and community services employee level 4—pay point 4’ under the Social, Community, Home Care and Disability Services Industry Award 2010.

| Old calculation | New calculation (from 5 August 2024) | |

|---|---|---|

| Annual rate of pay = hourly rate x 38 hours x 52 weeks (including all applicable amounts outlined under ordinary wages) | If the applicable industrial instrument specifies a weekly wage, calculate as follows: Annual rate of pay = weekly wage x 52 If the applicable industrial instrument does not specify a weekly wage but includes an hourly wage instead, calculate as follows: Annual rate of pay = hourly wage × full-time hours × 52 You can find more information about the calculation below. |

Please note:

Annual rate of pay is based on the minimum full-time hours for the applicable industrial instrument award, even if the worker is part-time or casual. This means it's:

- different to gross ordinary wages and not based on your workers' actual earnings AND

- used to calculate the value of reimbursement claims and doesn't impact the quarterly levy.

The gross ordinary wages and the annual rate of pay provide a complete picture of the workers' moderated wages, reflecting both the minimum wage for their award and their actual gross earnings.

Important information about annual rate of pay

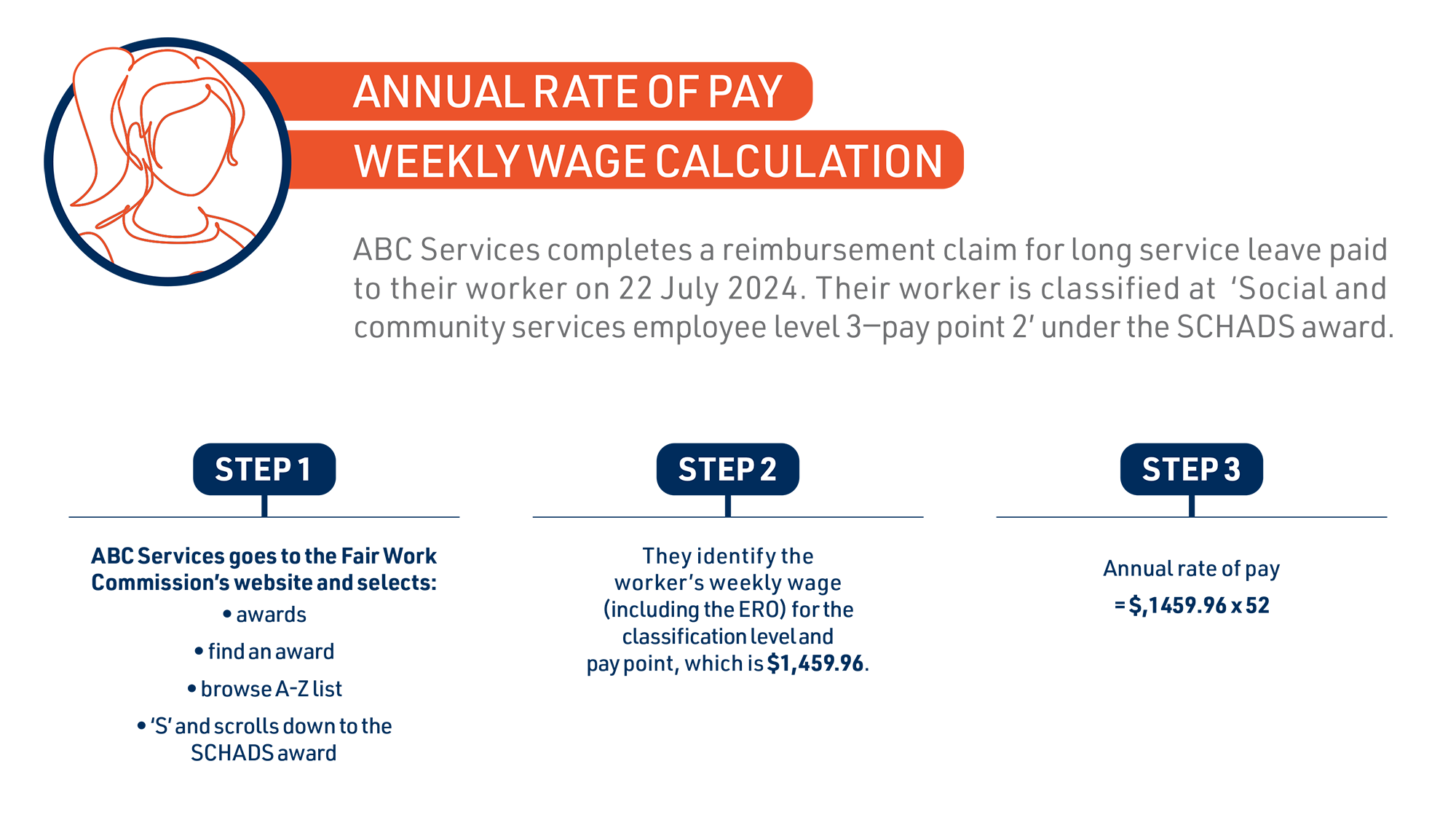

- If you are applying for reimbursement for long service leave you have paid to a worker, calculate the annual rate of pay at the point in time you paid the worker for their long service leave.

- If you are applying for reimbursement before a worker takes long service leave, calculate the annual rate of pay at the point in time you make the claim for reimbursement.

- Annual rate of pay is different to ordinary wages. Calculate the annual rate of pay based on minimum weekly or hourly wage. Do not include entitlements paid to workers in addition to minimum wage rates or which are dependent upon service (such as overtime, casual loading, allowances etc.).

- The only entitlement under an industrial instrument that should be factored into the annual rate of pay is the minimum wage, as varied by an equal remuneration order (ERO), if applicable.

- If your worker's industrial instrument is covered by an enterprise agreement, it's important you provide the full name of the agreement.

- If your worker's industrial instrument is covered by the SCHADS award, make sure you use the applicable award for the financial year you paid long service leave to the worker.

Key definitions

- Weekly wage - is the minimum weekly wage (including equal remuneration order, if any) for the worker’s classification level and pay point (if applicable) under the industrial instrument.

- Hourly wage - is the minimum hourly wage (including equal remuneration order, if any) for the worker’s classification level and pay point (if applicable) under the industrial instrument.

- Full-time hours - are the number of ordinary hours for full-time workers:

- in the industrial instrument applicable to the worker; or

- if no industrial instrument applies to the worker, in SCHADS Award, being 38 hours per week.

For help calculating your worker's annual rate of pay, you can use the user guide, video and frequently asked questions below.

Help with annual rate of pay - steps and video

Steps to calculate your worker's annual rate of pay

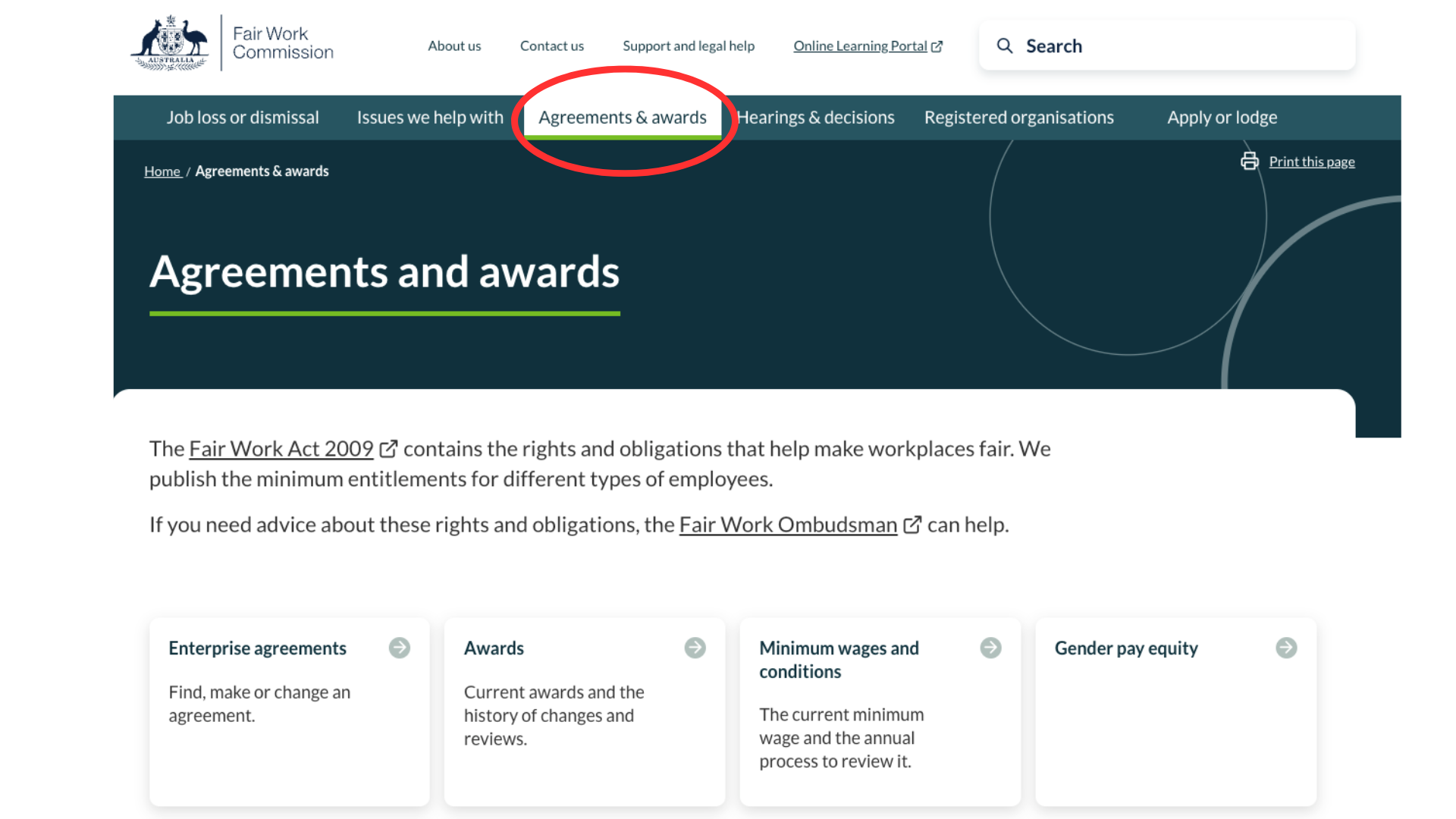

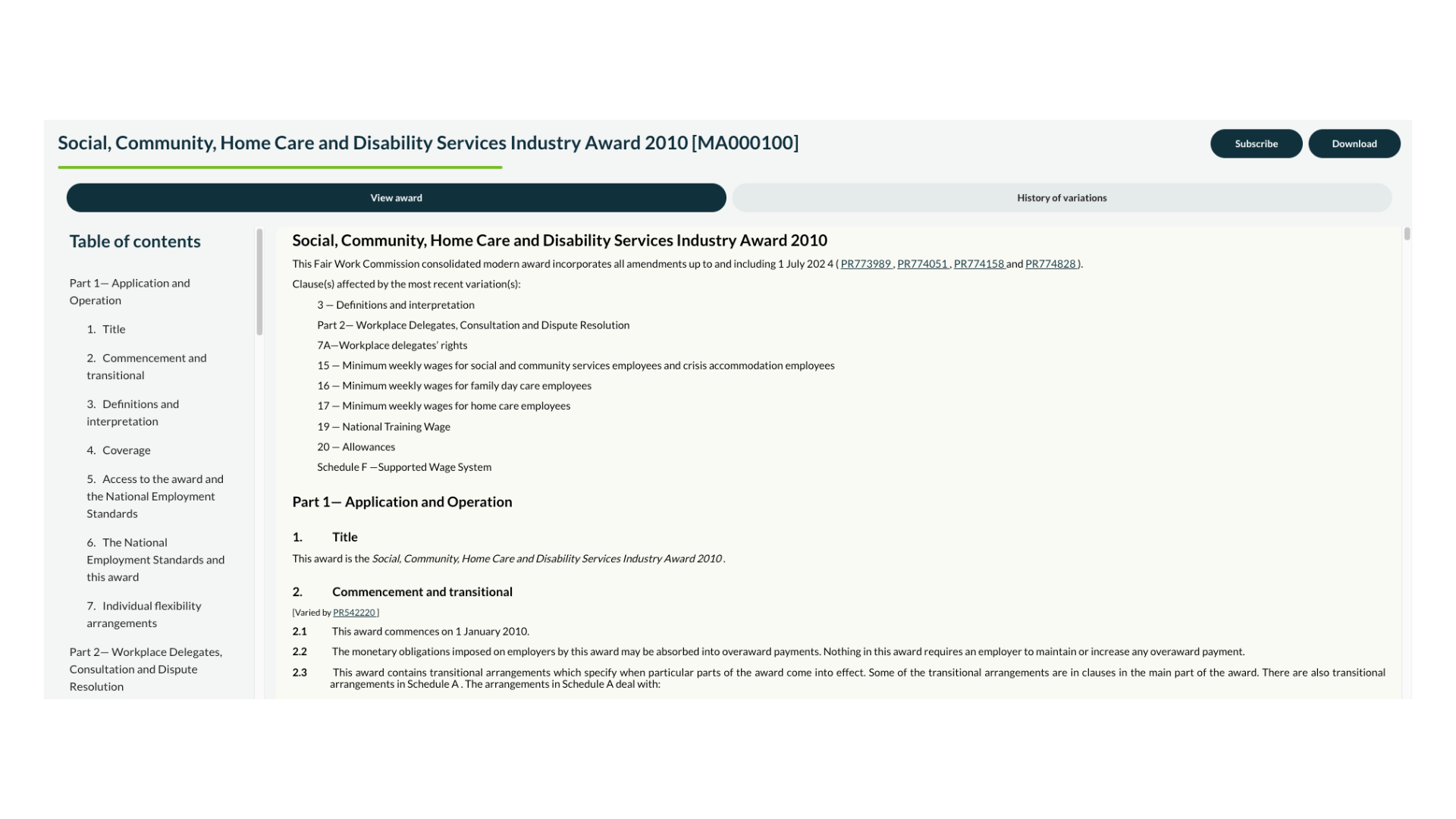

To complete the calculation, you'll need to identify the industrial instrument that applies to your worker and their classification level and pay point. 1. You can find current and historical versions of industrial instruments on the Fair Work Commission's website here, clicking agreement and awards. If your business has an enterprise agreement, you can find a copy by clicking agreements and awards, enterprise agreements and find an enterprise agreement. Make sure to provide the full name of the enterprise agreement.

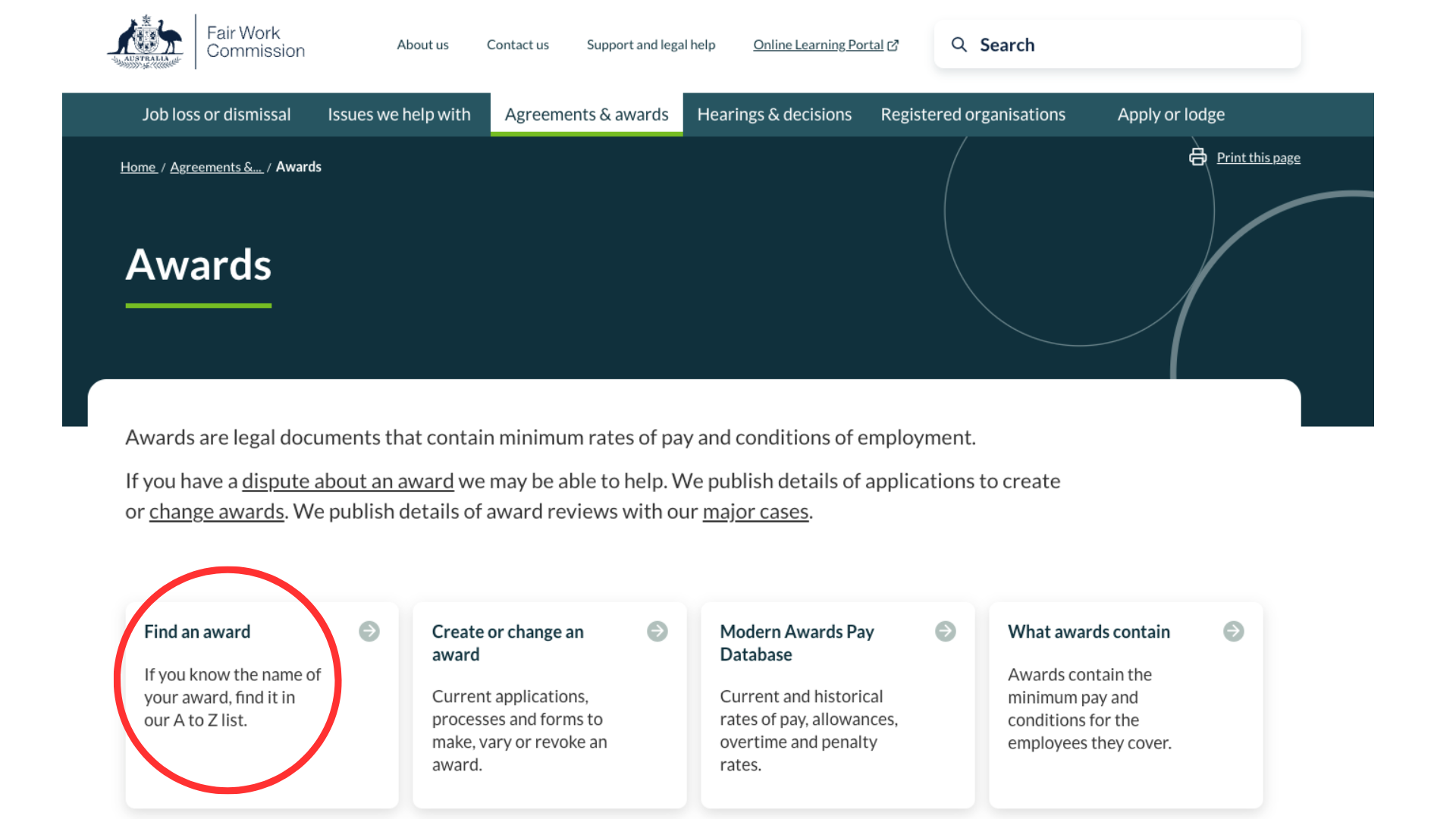

2. You can find a copy of a modern award by clicking agreements and awards and selecting find an award.

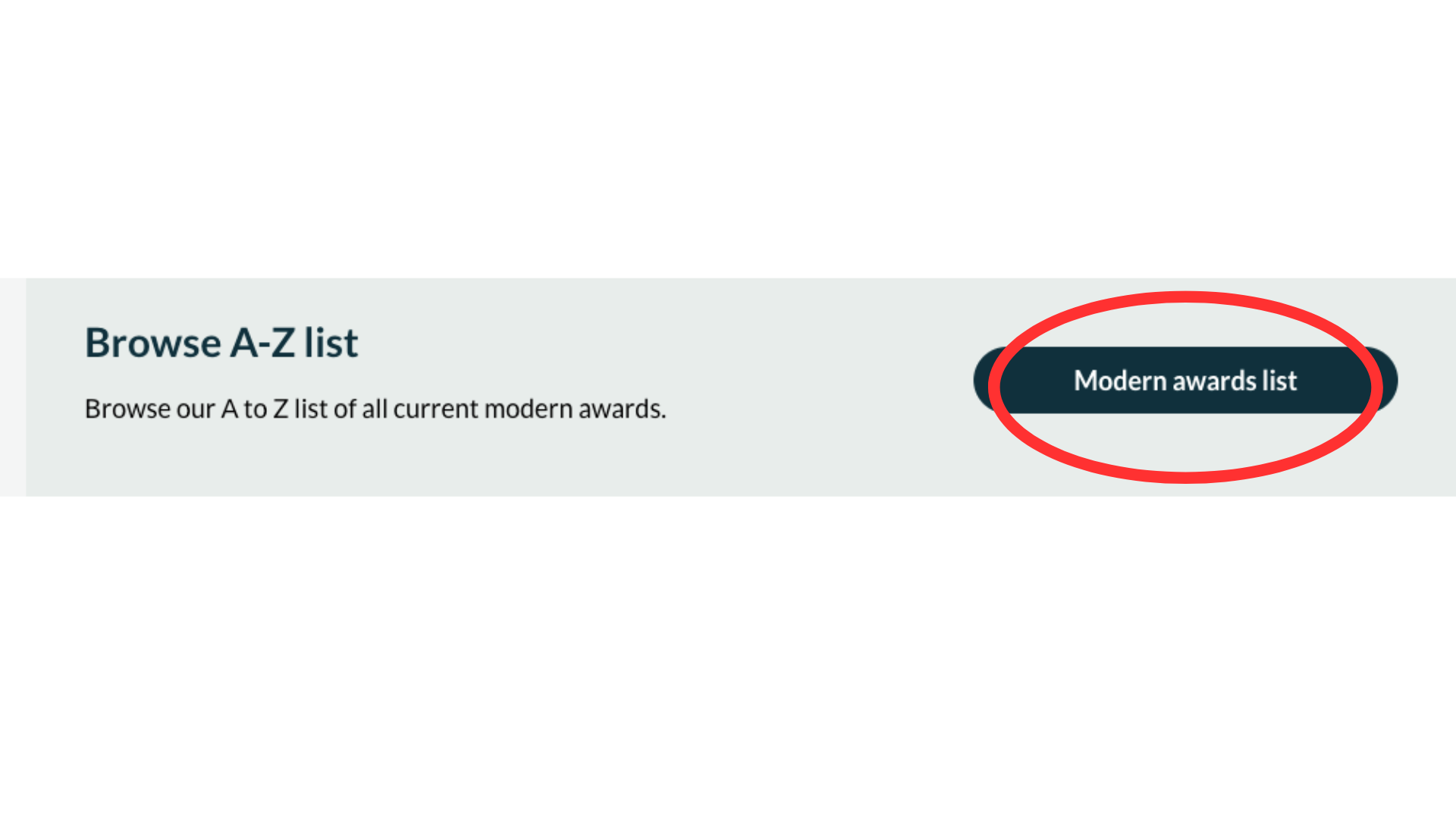

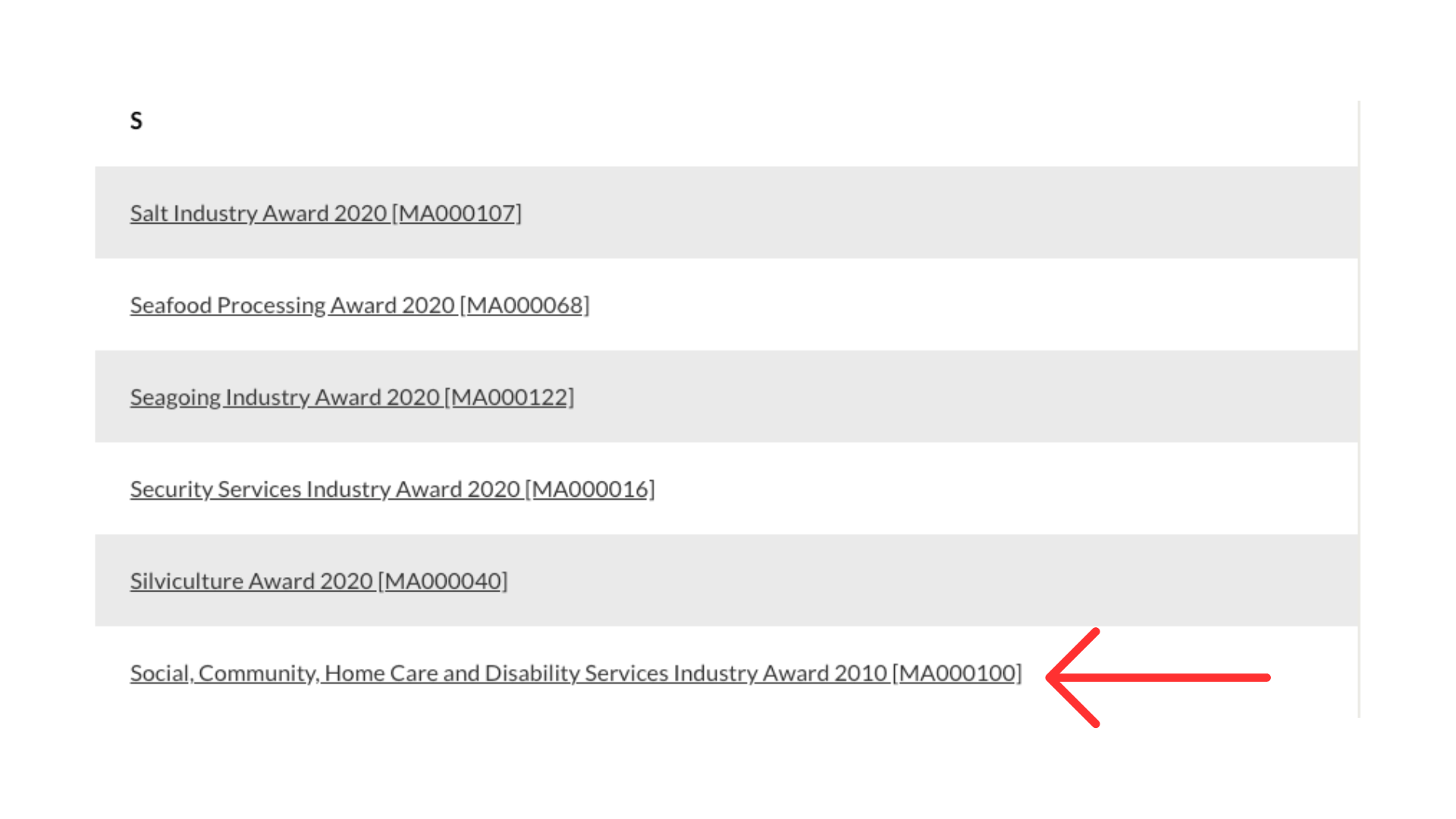

3. Select browse A-Z list and click modern awards list.

4. You can for example find the SCHADS award click the Social, Community, Home Care and Disability Services Industry Award 2010 by clicking 'S' and scrolling down.

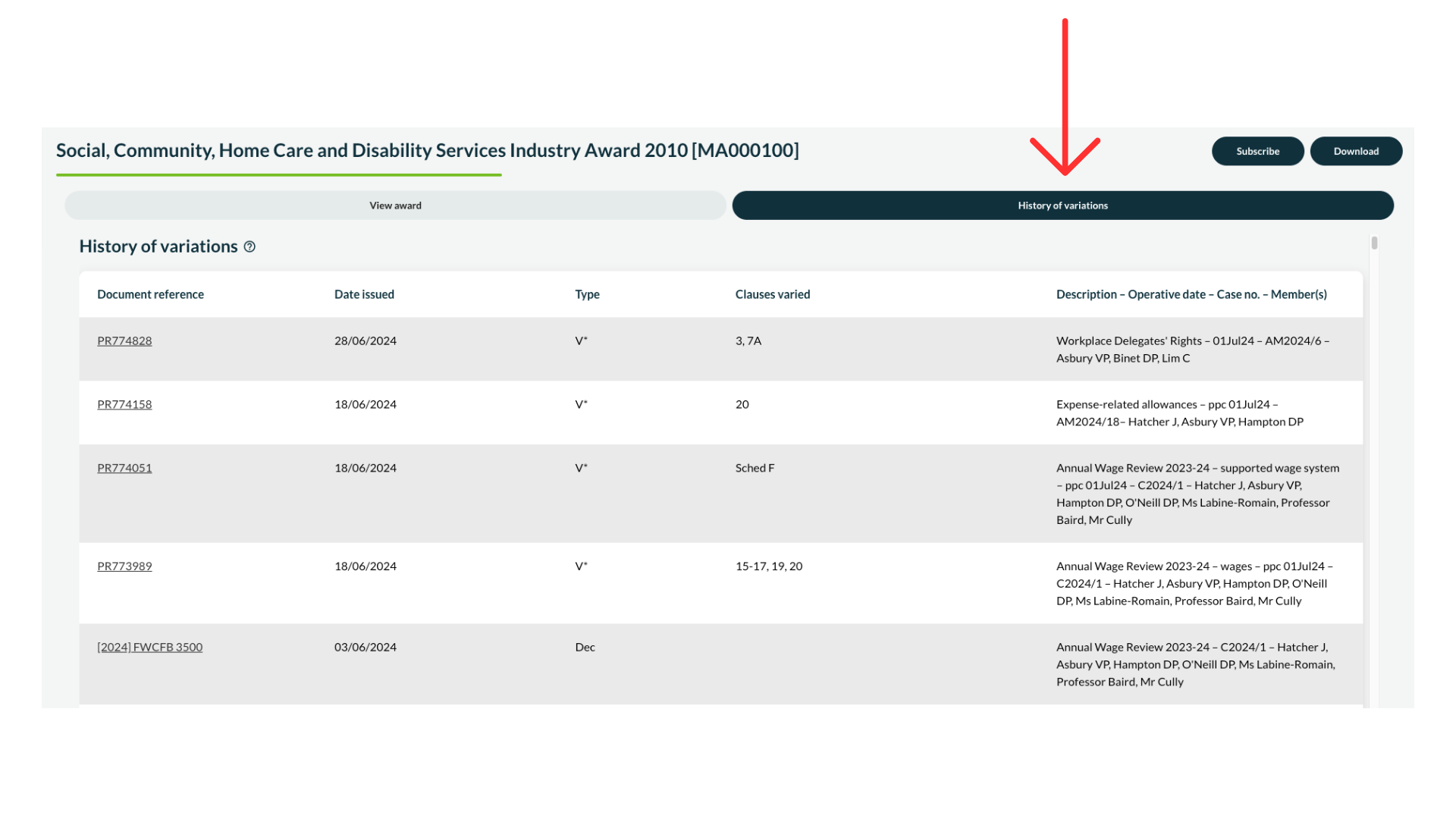

Make sure you use the applicable SCHADS award for the financial year you paid long service leave to the worker. For example, if you're making a long service leave claim for a worker who took leave on or after 1 July 2024, their award rate may be different from a worker who took leave before this date as it's not the same financial year. You can find historical awards on the Fair Work Commission's by clicking 'History of variations' up the top right corner.

For example, if an equal remuneration order applies (ERO), scroll down the page to find the rate of pay for the remuneration order in the industrial instrument for the worker’s classification level and pay point.

6.Once you find your worker's relevant wage rate, you can calculate their annual rate of pay using one of the below: If the applicable industrial instrument specifies a weekly wage, calculate as follows: Annual rate of pay = weekly wage x 52 If the applicable industrial instrument does not specify a weekly wage but includes an hourly wage instead, calculate as follows: Annual rate of pay = hourly wage × full-time hours × 52 Please note, annual rate of pay is based on the minimum full-time hours for the applicable industrial instrument award, even if they're part-time or casual. See a video guide on how to complete your workers' annual rate of pay here. You can also find more information about the annual rate of pay calculation below. |

More information about the calculation

Annual rate of pay calculation - using weekly wage

If the applicable industrial instrument specifies a weekly wage, calculate the annual rate of pay as follows:

Annual rate of pay = weekly wage × 52

Scenario 1 - annual rate of pay - weekly wage

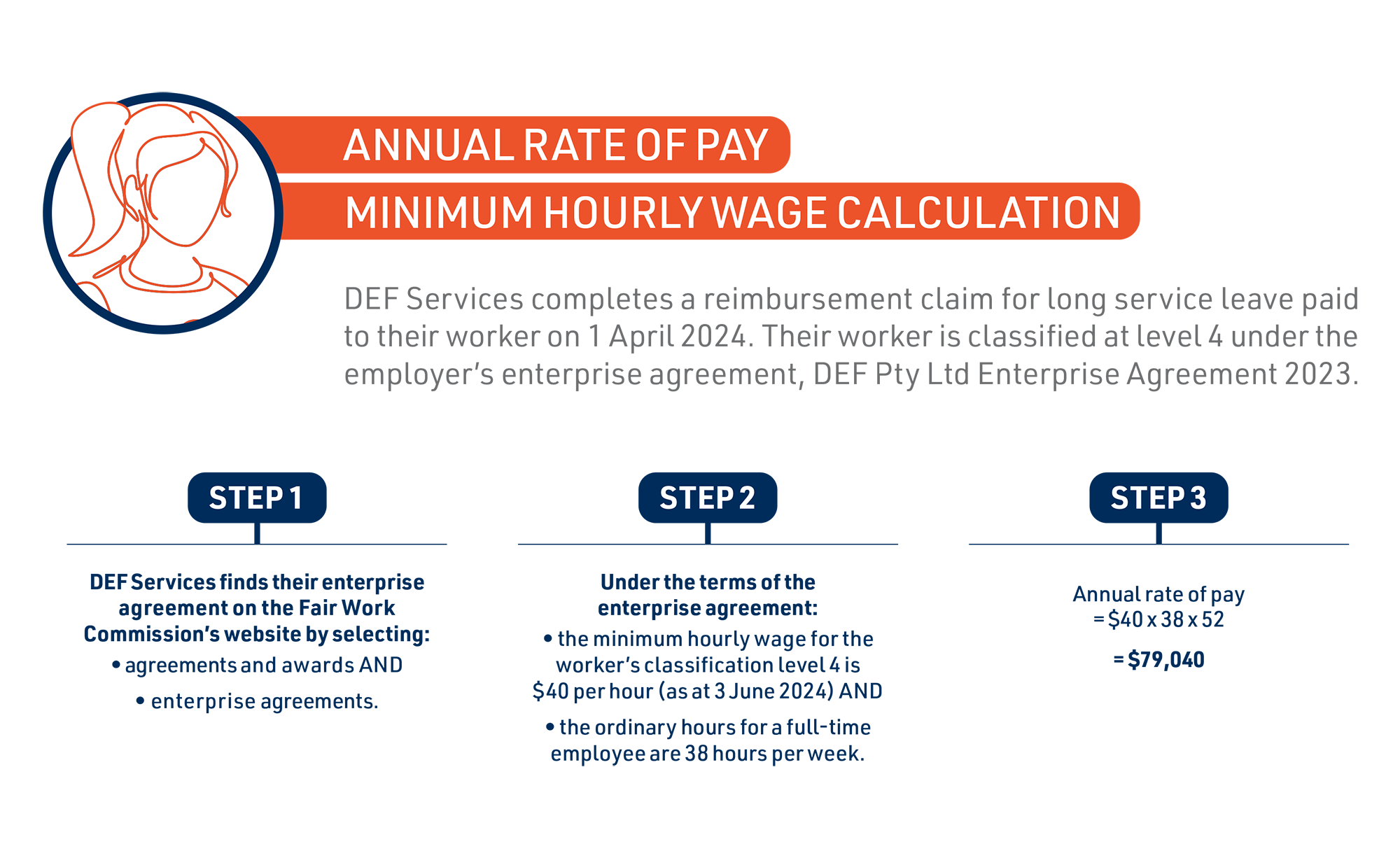

Annual rate of pay calculation - using hourly wage

If the applicable industrial instrument does not specify a weekly wage but includes an hourly wage instead, calculate the annual rate of pay as follows:

Annual rate of pay = hourly wage × full-time hours × 52

Scenario 2 - annual rate of pay calculation - using hourly rate

Frequently asked questions

Q: What is the annual rate of pay?

A: The annual rate of pay is the annual equivalent minimum wage for a worker’s classification level and pay point under the applicable industrial instrument (including any applicable equal remuneration percentage). Under the Community Services Industry (Portable Long Service Leave) Act 2020 (CSI Act), long service leave payments to registered workers and employers are calculated using both ordinary wages and the annual rate of pay.

Q: Why is the annual rate of pay relevant?

A: QLeave requires the annual rate of pay to calculate long service leave payments and reimbursement payments.

Q: What is the issue with the annual rate of pay?

A: To date, QLeave has advised employers that they should calculate a worker's annual rate of pay based on the worker's hourly rate (including all applicable amounts outlined under ordinary wages). This guidance does not reflect the requirements under the CSI Act.

Q: What is the new annual rate of pay guidance?

A: Employers now need to calculate the annual rate of pay for the worker's classification level and pay point under the relevant industrial instrument.

Q: What is an industrial instrument?

A: Industrial instruments set the minimum wages, conditions and entitlements for employees and employers covered within their scope.

An industrial instrument includes an award, certified agreement, enterprise agreement, arbitration determination, workplace determination, Fair Work Commission order, Division 2B State instrument and an instrument given continuing effect under the Fair Work (Transitional Provisions and Consequential Amendments) Act 2009 (Cwlth), schedule 3, part 2.

A contract of employment is not an industrial instrument.

Q: What is a classification level?

A: A classification level is the level or grade a worker is classified at under the industrial instrument that applies to the worker. The classification level may be determined based on the worker’s role, duties and responsibilities, qualifications, experience or other considerations.

A worker’s classification level may change during their employment (e.g. if their role changes or they obtain a relevant qualification).

Q: What is a pay point?

A: Some industrial instruments include pay points for employees to progress through as they gain experience and qualifications.

Q: Where can employers access the new guidance?

A: QLeave’s website provides guidance to employers about completing worker service returns.

Q: How does the guidance differ for returns and claims?

A: For returns, the employer needs to provide the annual rate of pay for each worker as at the end of the quarterly return period. For example, for the return due on 14 October 2024 the annual rate of pay is calculated as at 30 September 2024.

For reimbursement claims, the employer needs to provide the annual rate of pay at the time they paid long service leave to the worker.

Q: Where do employers find the correct rate of pay for their workers?

A: Employers can locate current and historical versions of federal modern awards (here) and enterprise agreements (here) on the Fair Work Commission’s website.

Q: What amounts are to be included in the annual rate of pay calculation?

A: Calculate the annual rate of pay based on minimum weekly or hourly wage. Do not include entitlements paid to workers in addition to minimum wage rates or which are dependent upon service (such as overtime, casual loading, allowances etc.)

Q: Is the annual rate of pay the same as ordinary wages?

A: No, the annual rate of pay is different from ‘ordinary wages’ under the CSI Act. The annual rate of pay is calculated based on the annual equivalent minimum wage for a worker’s classification level and pay point under the applicable industrial instrument (including any equal remuneration order percentage). The ‘ordinary wages’ amount provided in quarterly returns includes over award payments, allowances, casual loading, leave entitlements and other payments to workers.

Q: How do I calculate the annual rate of pay if my worker is part-time or casual?

A: You always calculate the annual rate of pay based on our workers' minimum full-time hours, not on the hours they worked, even if they're part-time or casual. The gross ordinary wages and the annual rate of pay provide a complete picture of the worker's moderated wages, reflecting both the minimum wage for their award and their actual gross earnings.

- Gross ordinary wages: reflect the worker's actual earnings.

- Annual rate of pay: reflects the minimum annual rate of pay for a full-time equivalent position.

Q: What if a worker is not employed under an industrial instrument

A: If an industrial instrument does not apply to a worker, you must provide the annual rate of pay for the prescribed classification level under the Community Services Industry (Portable Long Service Leave) Regulation 2020. This classification level is the ‘Social and community services employee level 4—pay point 4’ under the Social, Community, Home Care and Disability Services Industry Award 2010.

Q: What makes this new annual rate of pay guidance different from the previous one provided by QLeave?

A: Previously, QLeave advised employers to calculate the annual rate of pay using the worker’s hourly rate (including all amounts outlined under ‘ordinary wages’ in the CSI Act) x 38 hours x 52 weeks. 'Ordinary wages’ is the gross wages paid or payable to a worker and includes amounts that should not be included in the annual rate of pay such asweekend and public holiday penalty rates earned by a shift worker on normal rostered shifts in their ordinary hours of work, allowances relating to a person’s worker, over-award payments.

The new guidance requires employers to calculate the annual rate of pay based on the minimum wage rates (including any equal remuneration order percentage) for the worker’s classification level and pay point under their relevant industrial instrument.

Q: How will QLeave check if the information provided is correct?

A: In the new claims process, employers will need to provide the industrial instrument, classification level and pay point, as well as the annual rate of pay, for auditing purposes.

Q: Do employers need to provide the corrected annual rate of pay for all workers for all previous returns?

A: Not as part of the current remediation process, which is only for claims. Eventually, QLeave will need to collect this information for all workers. QLeave will consider the best way to collect this information once the new claims process is underway and historical claims have been remediated.

Q: Are workers’ entitlements affected by the error with the annual rate of pay calculation?

A: The annual rate of pay forms part of the calculation for long service leave payments. Workers are not able to claim long service leave payments directly from QLeave until 2028 therefore workers are not impacted by this error.

Q: Does the change in how we calculate the annual rate of pay impact my levy payments?

A: No. The levy rate remains 1.35% of the gross ordinary wages reported on your return. The annual rate of pay doesn't impact the levy.

5. Find the minimum wage rate for your worker's classification and pay point.

5. Find the minimum wage rate for your worker's classification and pay point.